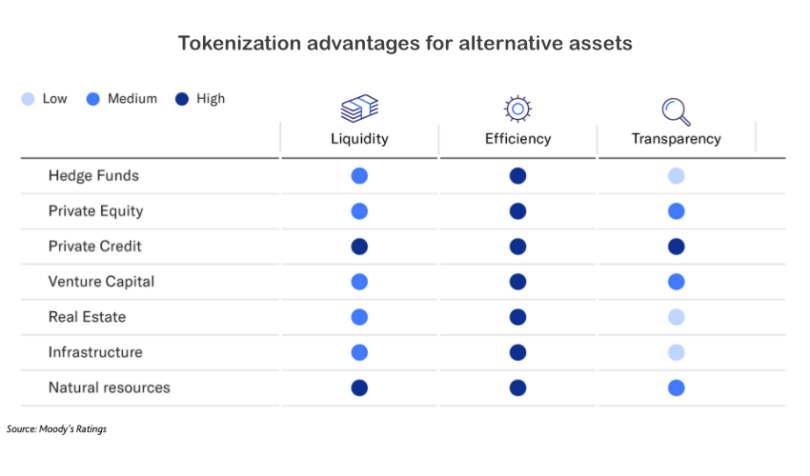

This week Moody’s published a mini report on the tokenization of alternative assets. It finds that blockchain-based secondary markets could boost liquidity and help with efficiencies. However, the question is whether alternative asset managers are keen on greater transparency.

It’s widely known that alternative assets are relatively illiquid. Lockup periods, high investment minimums, and restrictions to accredited investors often apply to alternative assets such as private equity, private credit, and hedge funds.

Tokenization can fractionalize the investment amounts, making them accessible to a wider audience. Depending on the risks, in many cases that might still exclude retail investors. Instead, high network worth individuals might invest alongside institutions, but even for institutional investors, fractionalization supports greater diversification.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.