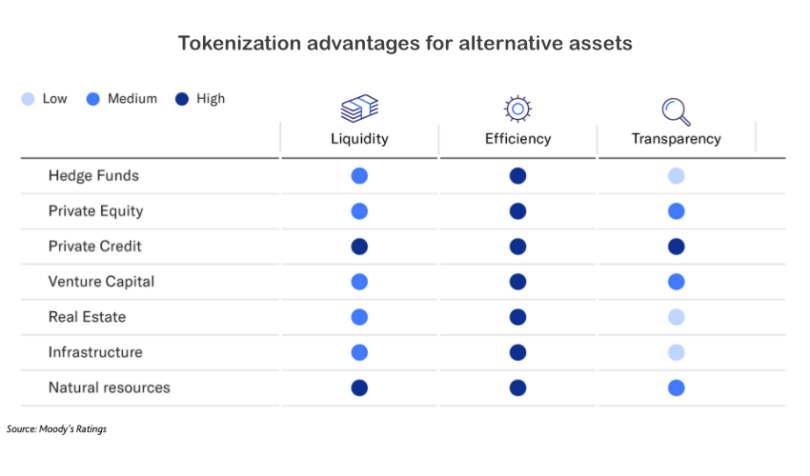

This week Moody’s published a mini report on the tokenization of alternative assets. It finds that blockchain-based secondary markets could boost liquidity and help with efficiencies. However, the question is whether alternative asset managers are keen on greater transparency.

It’s widely known that alternative assets are relatively illiquid. Lockup periods, high investment minimums, and restrictions to accredited investors often apply to alternative assets such as private equity, private credit, and hedge funds.

Tokenization can fractionalize the investment amounts, making them accessible to a wider audience. Depending on the risks, in many cases that might still exclude retail investors. Instead, high network worth individuals might invest alongside institutions, but even for institutional investors, fractionalization supports greater diversification.

Additionally, secondary markets can address the inability to withdraw funds for long periods.

But do asset managers want this? Some certainly do with KKR, Hamilton Lane and Apollo testing the waters.

“Blockchain provides investors with real-time access to information regarding their investments and underlying assets,” write Moody’s. Fund distribution firm Calastone has been talking for years about tokenizing the fund’s underlying assets, not just the fund units.

As Moody’s notes, some asset managers are protective of their unique strategies. They view it as their secret sauce to achieve higher yields, and transparency could mean they lose their edge. Additionally, monitoring the details in real time may result in a shift towards short term performance.

The Moody’s paper touches on the role of artificial intelligence (AI) arguing it can help in processing analytical data, navigating regulations and portfolio management.

Apart from this paper, Moody’s also published a note on DeFi automated market makers (AMMs).