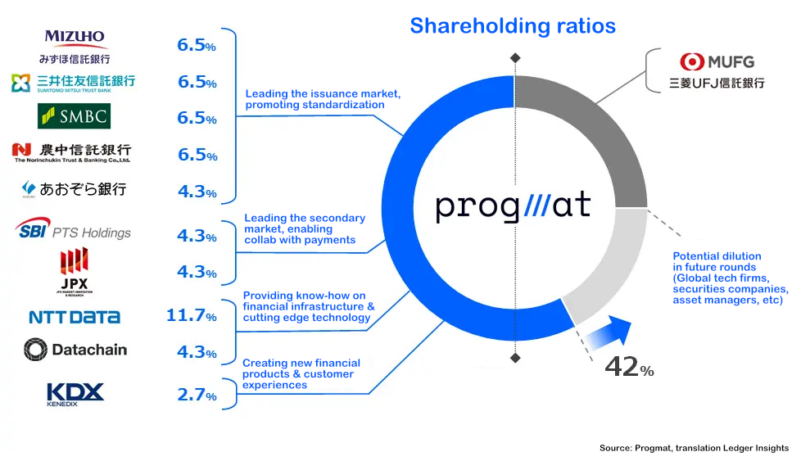

Earlier this week Japan’s Progmat digital securities platform announced a new funding round featuring three new investors. The platform was originally founded by Japan’s largest bank, MUFG, but with this latest funding the bank’s shareholding was diluted from 49% to 42%. The amount of the ‘pre Series A first closing’ was not disclosed.

The new investors are Nochun Trust and Banking, Aozora Bank and real estate firm Kenedix.

With the new funding round, other shareholders were diluted, including the three other banks, SMBC, Mizuho and Sumitomo Mitsui Trust, which each previously held 7.5% and now own just under 6.5%.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.