BRØK, the Norwegian government project to track unlisted stock ownership, moved into the sandbox phase earlier this month. What’s a little different compared to other solutions is it plans to use a public blockchain. Specifically, it is using Arbitrum, a layer 2 scaling solution for Ethereum with lower transaction costs.

Many countries around the world have corporate registries where you can look up information on companies of any size, including unlisted ones. These often have some stockholder data, but it’s usually up to a year old. For up-to-date details, one needs to contact the company. Norway’s corporate registry, which keeps records on 380,000 companies, is no different.

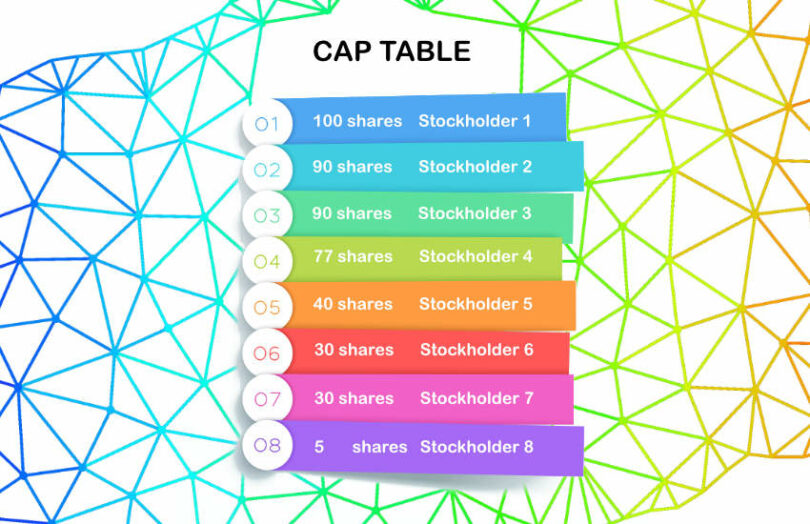

Hence the concept of creating a blockchain system to track the change of ownership of any private stock and get a current view of the ‘cap table’ – who owns stock, how much they own and when they bought it.

Another benefit of using a blockchain is immutability. Because companies only share snapshots of stock ownership irregularly, there’s scope to manipulate the cap table, although it’s not a particularly common fraud. In fact, the most likely victim is the government if there are share transfer taxes and there’s a desire to shift the timing. Unsurprisingly the tax agency is a participant in the ecosystem.

There are benefits to the company as well. The most obvious one is they only have to log stock transactions rather than manage the cap table. It makes it easier to sell stock with less due diligence on the cap table itself. That’s because the buyer and seller have to agree to blockchain transactions, providing some level of third party validity. Additionally, stock can be used as security for a loan, and the charge over the stock will also be logged on the blockchain.

The solution provides a good foundation for the coming wave of tokenization as stocks are stored using the ERC1400 Ethereum security token standard.

The project has been in the works for some time with the developer Blockchangers posting code for a solution three years ago, which has moved on since then. Now it is making the software development kit (SDK) available.

BRØK combines blockchain, an open database and custom software. The solution is GDPR compliant, so personal information is not stored directly on the blockchain. However, it uses the Ceramic protocol for the personal information, an open distributed database that allows for data to be deleted and corrected, as required by GDPR.

This might be one of the first times a government is using blockchain for cap tables, but it’s far from being the first cap table solution. One of the first for private securities was Swiss firm daura, a joint venture between BDO, BEKB, SIX, Swisscom and Sygnum. Another Swiss example is Aequitec. In the U.S., Figure Technologies has developed a cap table solution using its Provenance public blockchain.