Yesterday, the Russian National Settlement Depository (NSD) published a report on its vision for blockchain in finance. It covers asset tokenization, standards, governance, and the NSD’s “extensive experience” in implementing blockchain projects.

The organization’s Director for Innovations, Artyom Duvanov, said: “In some cases, implementing blockchain allows the simplification of system architecture and provides clients with a cheaper solution as compared to the centralized ones.”

He continued: “The emergence of new types of digital assets can also contribute to the quicker implementation of the distributed ledger technology; it lets us provide the market transparency required by regulators and allows the protection of investor rights.”

The report reveals that the NSD has already participated in various blockchain initiatives. They include automated voting at general meetings, a pilot for issuing commercial paper with smart contracts, testing transactions for raising funds with tokens, and a distributed digital depository project. Last year, it used its blockchain to issue a bond, which was redeemed by Sberbank.

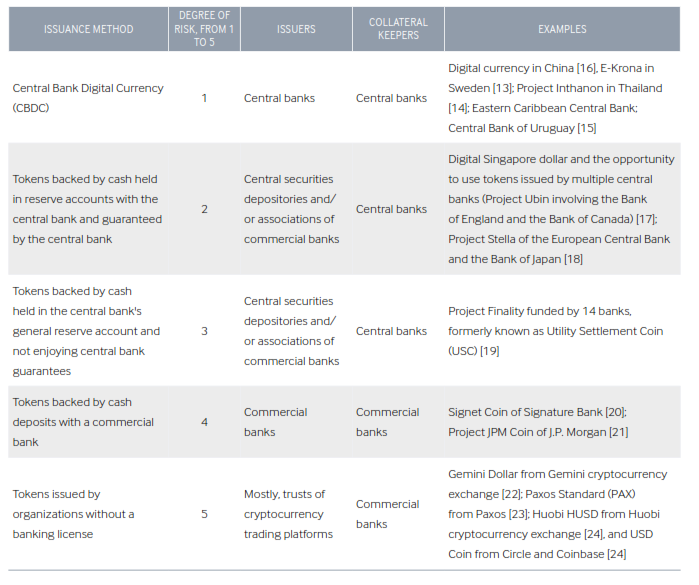

The NSD also shared that, since the launch of its blockchain lab in 2015, it works with Hyperledger and the International Securities Services Association (ISSA). With ISSA’s classification, the report sorts out multiple tokenized cash projects by risk. These include China’s central bank digital currency (CBDC), the Utility Settlement Coin (USC), and the JPM Coin:

The report points out that few tokenization projects reach the stage of commercial use. In general, only 4% of 398 high profile enterprise blockchain projects were deployed. One of the main reasons for this is the lack of confirmed demand for blockchain from business, the state, or regulators.

Indeed, the NSD considered this an “essential prerequisite for success”. It found that demand could be driven by transparency, efficiency, and the possibility that a new blockchain system could attract and manage more retail investors.

Going further than many whitepapers, the report puts forward questions to be considered before applying blockchain to assets. Is an asset to be tokenized sufficiently liquid? Who will issue the token on the blockchain? How will it be governed? Without confirmed demand and reliable answers to these questions, blockchain may not be the answer.

Instead of just listing the benefits of the technology, without its possible downsides, the NSD has taken a balanced approach which reflects its experience. For instance, tokenizing an asset doesn’t automatically make it liquid.

The report concludes: “A blockchain platform could facilitate the introduction of new settlement models and the provision of such services as, for example, factoring.”

“Transferring the entire set of business processes associated with a certain asset or service type to blockchain, adding tokenized funds to the blockchain perimeter, and adapting the financial infrastructure to transactions in new asset types using distributed ledger technology seem to be the most cost-efficient option.”