Last Monday the New York Stock Exchange and its parent the Intercontinental Exchange (ICE) announced plans for a new trading venue for tokenized securities. The three primary benefits touted were a 24/7 exchange, instant settlement using stablecoins and the ability to trade fractional shares in notional dollar amounts.

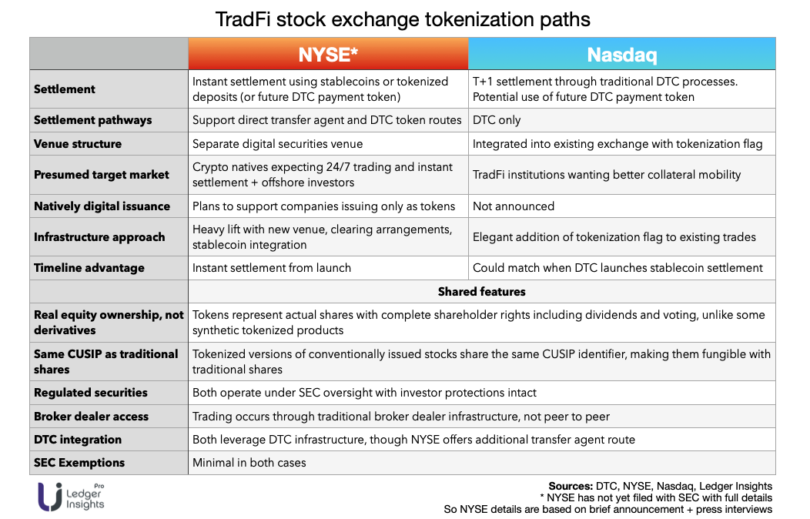

The stock exchange has already been in discussions with the SEC, and given it is planning a new venue it will have to publicly reveal its plans at some point. It raises several questions. Current regulations require intermediaries for settlement, usually the DTC or sometimes transfer agents. What’s the plan? The NYSE has chosen to launch a separate venue, whereas Nasdaq will offer unified trading, with the option to settle in tokenized or conventional form. Why these different approaches? What sorts of blockchains will be supported?

A notable aspect of the NYSE announcement was it did not mention the DTC, the central securities depositary that processes quadrillions in dollars of settlement every year. The DTC received an SEC no action letter in December allowing it to support tokenization, and Nasdaq tightly linked its tokenization plans to the DTC’s.

Later last week, there were two revealing NYSE statements. NYSE President Lynn Martin told Fox News that the new venue “will enable stock owners to take shares at DTC and move to our platform.” ICE’s Michael Blaugrund spoke to Bloomberg, saying “We expect to work with digital transfer agents as well as DTC to ensure we have a comprehensive solution.”

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.