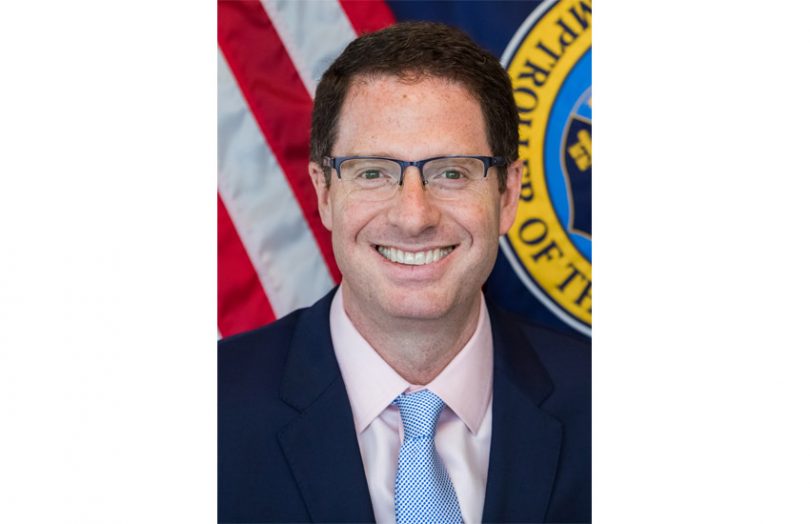

Today blockchain credit startup Spring Labs announced that Brian Brooks is joining its board as an independent director. Until January, Brooks served as Acting Comptroller of the Currency at the OCC, the U.S. national banking regulator. That followed a stint as Chief Legal Officer of Coinbase, the cryptocurrency exchange.

When Brooks joined the OCC he had to give up several part-time roles, including as an advisor to Spring Labs from March 2018 to 2020.

“Spring Labs is transforming financial data exchange in a way that is better for consumers,” said Brian Brooks. “I launched my financial inclusion initiative Project REACH while at the OCC, and I look forward to working with the Spring Labs team to bring the benefits of financial services to more Americans, while reducing cost and increasing security for everyone.”

While Brooks led OCC it published several interpretive letters, including allowing banks to participate in stablecoin networks. Previous letters paved the way for banks to custody digital assets and hold stablecoin reserves.

When Spring Labs first burst on the scene, it positioned itself as a decentralized competitor to Equifax, but has since evolved.

Spring Labs uses a permissioned blockchain to control who can see credit transaction data. “This combination of data opacity and transaction transparency is a key to resolving the age-old problem of information sharing among competitors,” said the company in a statement.

One of its highest profile applications is for PACE loans, a government-supported scheme to support renewable energy installation funding. Spring Labs’ system helps prevent fraud by detecting whether contractors apply for multiple loans at different credit providers for the same job. By enabling some of the application data to be shared but yet balancing that transparency and opacity, competitive lenders can identify fraud to their mutual benefit. So far, it has detected 1% of loans as fraudulent and estimates this saves the sector 10% of annual revenues.

To date, Spring Labs has raised more than $38 million in funding from the likes of GM Financial, SoFi, and Avant. Until he joined the OCC, Brooks was also a director of Avant, which may be how he came in touch with Spring Labs. The startup’s co-founder and President John Sun was also a co-founder of Avant a consumer lending startup that has raised more than $1.6 billion in equity and debt, according to Crunchbase.

Meanwhile, Spring Labs has an existing high profile team of advisors that includes Sheila Bair, former Chair of the FDIC and Gary Cohn, former President of Goldman Sachs.