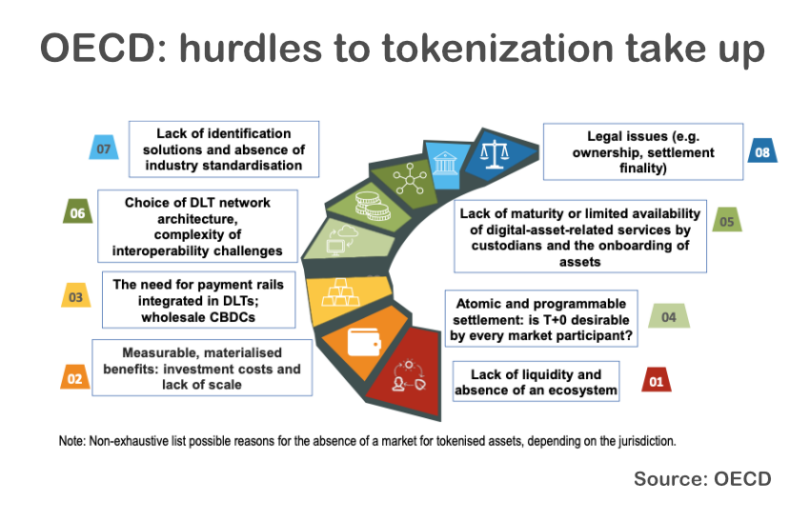

The Organisation for Economic Cooperation and Development (OECD) published a report exploring why tokenization hasn’t taken off faster. It briefly outlines the many potential benefits of tokenization including efficiency gains, improved securities settlement and the opportunities for innovation. It then explores the potential impediments to tokenization.

One challenge is the lack of a critical mass of investors, which makes issuers more reluctant to go down the tokenization route. In turn, that creates a lack of liquidity. The OECD noted that sovereign bond issuances can help, citing the Slovenia one.

We’d observe that quasi-sovereign issuers have been the most active, like the World Bank, the European Investment Bank (EIB) and various regions in Switzerland. Plus, the liquidity issue has often been addressed through integrations with conventional systems. However, the OECD highlights that if you’re integrating with conventional systems, then that cancels out some of the potential benefits.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.