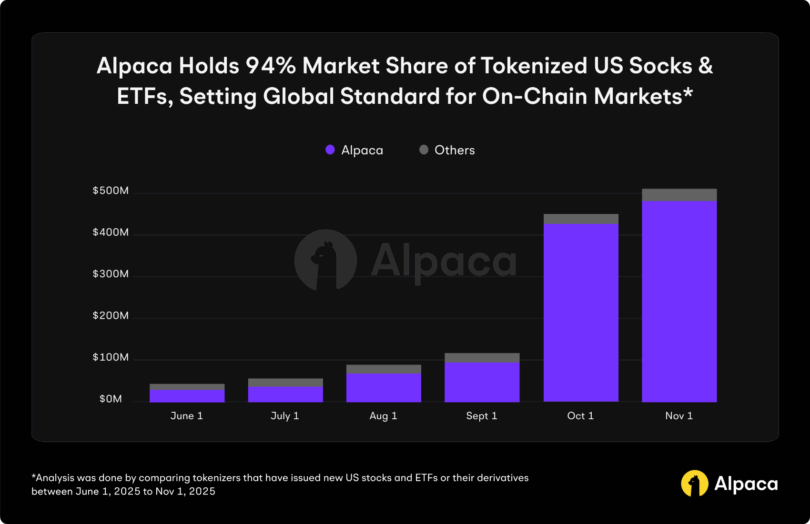

In the past few months there has been a flurry of activity with several companies launching tokenized stock offerings targeting retail investors. Alpaca Securities, a US licensed broker dealer and fintech, claims to hold 94% of US-listed tokenized stocks in custody. It provides brokerage and trading APIs enabling automation, which has proven attractive to startups specializing in tokenized stocks. The two current market leaders, Ondo Global Markets and xStocks, are both clients, which is why Alpaca’s claim is credible.

At the start of November Alpaca had $480 million in assets under custody. Its two largest clients have since grown substantially, with Ondo Global Markets now at $390 million in issuance (Source: DeFi Llama) and xStocks at $182 million. Robinhood, which doesn’t use Alpaca and represents much of the remaining 6% of the market, has $12 million according to Dune Analytics. Earlier this week Kraken announced it acquired Backed, the issuer of xStocks.

So what are the stocks that appeal to crypto investors? According to Alpaca, six stocks make up around three quarters of the total. This includes Tesla and Nvidia stock, with funds making up the balance including two S&P 500 trackers, one Nasdaq 100 tracker and a 20 year+ Treasury fund. However, the offerings don’t all have quite the same profile. xStocks and Robinhood have lower proportions of tracker funds, with other Big Tech stocks, Circle and Coinbase also proving popular.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.