A recent report by the

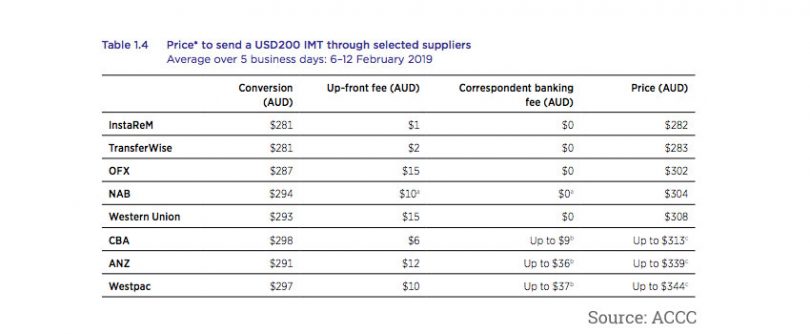

Australian Competition and Consumer Commission (ACCC) has found that Australians could have saved A$150 million ($102 million) on international transfers. The extra costs were because consumers used the Big Four Australian banks instead of international money transfers (IMT) services.

The ACCC conducted an inquiry into the supply of foreign currency conversion (FX) services in Australia. It was revealed that new entrants are delivering better consumer outcomes. To protect these recent gains and promote competition, the ACCC has recommended barriers to expansion are removed for the non-bank IMT suppliers. Additionally, consumers should get a transparent view of FX prices.

A key finding was that some non-banking IMT services have been denied access to banking services to comply with Australia’s anti-money laundering (AML) and counter-terrorism financing (CTF) laws. Others have had threats of their banking access being terminated.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.