A recent report by the Australian Competition and Consumer Commission (ACCC) has found that Australians could have saved A$150 million ($102 million) on international transfers. The extra costs were because consumers used the Big Four Australian banks instead of international money transfers (IMT) services.

The ACCC conducted an inquiry into the supply of foreign currency conversion (FX) services in Australia. It was revealed that new entrants are delivering better consumer outcomes. To protect these recent gains and promote competition, the ACCC has recommended barriers to expansion are removed for the non-bank IMT suppliers. Additionally, consumers should get a transparent view of FX prices.

A key finding was that some non-banking IMT services have been denied access to banking services to comply with Australia’s anti-money laundering (AML) and counter-terrorism financing (CTF) laws. Others have had threats of their banking access being terminated.

Hence, the report recommends that the Australian Government develop a scheme to help IMT suppliers address due diligence requirements.

According to the ACCC, about A$21 billion is sent by consumers from Australia to other countries every year. The ACCC said consumers face three significant challenges with IMT — prices are complex, prices are presented in different ways, and prices lack transparency. The Australian Government is also keen to reduce the cost of transfers and backs two websites, SendMoneyPacific and SaverAsia, which compare costs in key remittance corridors.

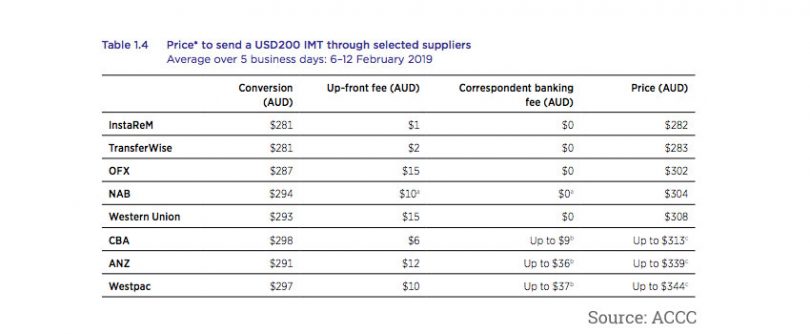

One of the transfer companies, InstaReM, a non-banking IMT service, was found to offer one of the cheapest options for sending money overseas. InstaReM uses Ripple’s xRapid to make payments using the XRP cryptocurrency in the background. This means it doesn’t need so many foreign bank accounts. With blockchain, payments can be made more efficiently and transparently.

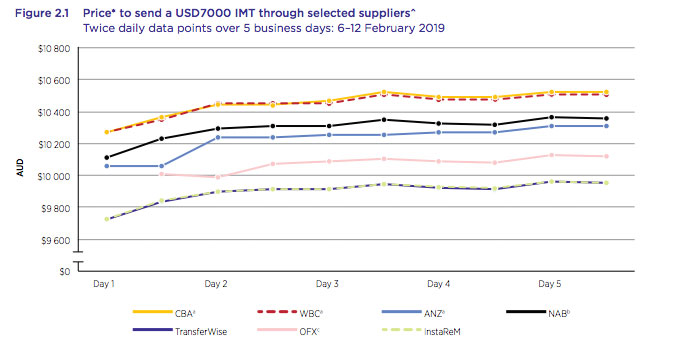

Both InstaReM and Travelex demonstrated significantly lower costs than the big banks. InstaReM was slightly cheaper for smaller transfers, but the two companies offered almost identical prices for remitting larger amounts.

“At InstaReM, we have an innovative P2P model that effects transfers at Zero-Margin FX rates (mid-market rates). We also bypass the SWIFT network, which makes the transfers cost-effective and speedier for consumers. We only charge a small transfer fee — fair and transparent — that typically varies from 0.25-0.6% of the amount sent,” said Prajit Nanu, CEO of InstaReM.

The legacy system for international bank transfers is inefficient and involves several charges. Because banks don’t have accounts at every other bank in the world, they tend to use correspondent banks as go-betweens. That adds unpredictable costs, reduces transparency and sometimes causes delays. There is also backend manual labor required to process payments within banks in different regions, which can introduce errors into the transaction.

Quite a few money transfer companies around the world are using Ripple’s technology. Some use xCurrent, which is Ripple’s modern alternative to SWIFT but does not use XRP. An example is Ria. Others use XRP such as Viamericas – where the IFC, part of the World Bank is a large shareholder. Ripple also recently made a significant investment in MoneyGram which will use xRapid and XRP.