A survey conducted by the Federal Reserve Bank of Philadelphia on central bank digital currency (CBDC) revealed privacy concerns are less significant than anticipated. Plus, using CBDCs for cross border payments was considered a lower priority for consumers.

The Consumer Finance Institute (CFI) at the Federal Reserve conducted the survey in 2022, with the findings released this week. While a substantial number of the more than 5,000 respondents did not feel confident enough to express an opinion, over 52% were warm to the topic of CBDC.

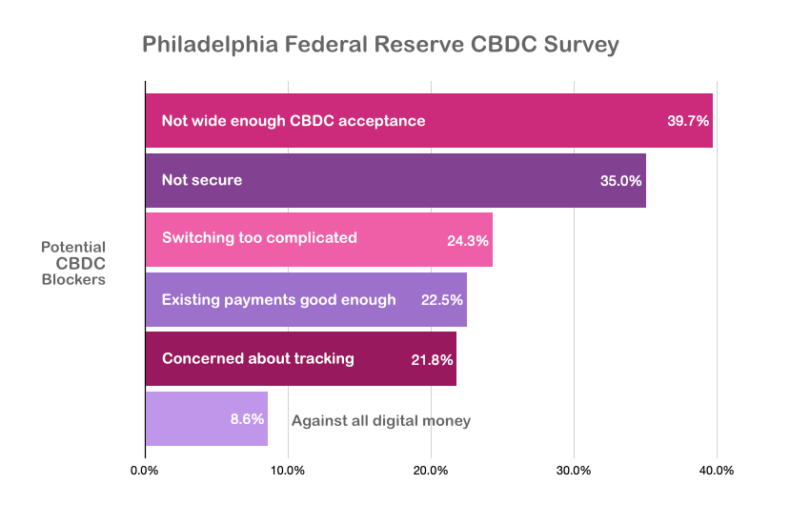

In the United States, considerable anti-CBDC sentiment exists, largely due to fears of government monitoring of payments. The survey, however, indicates that while privacy is a concern, it may not be as critical as some believe.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.