A survey conducted by the Federal Reserve Bank of Philadelphia on central bank digital currency (CBDC) revealed privacy concerns are less significant than anticipated. Plus, using CBDCs for cross border payments was considered a lower priority for consumers.

The Consumer Finance Institute (CFI) at the Federal Reserve conducted the survey in 2022, with the findings released this week. While a substantial number of the more than 5,000 respondents did not feel confident enough to express an opinion, over 52% were warm to the topic of CBDC.

In the United States, considerable anti-CBDC sentiment exists, largely due to fears of government monitoring of payments. The survey, however, indicates that while privacy is a concern, it may not be as critical as some believe.

Two questions underscored privacy concerns. Respondents were asked to rank features in terms of importance. Cost emerged as the primary appeal, with 63% of those favoring a no-fee option. The next most critical factor is the widespread acceptance of CBDCs (57.3%), with privacy coming in third (42%).

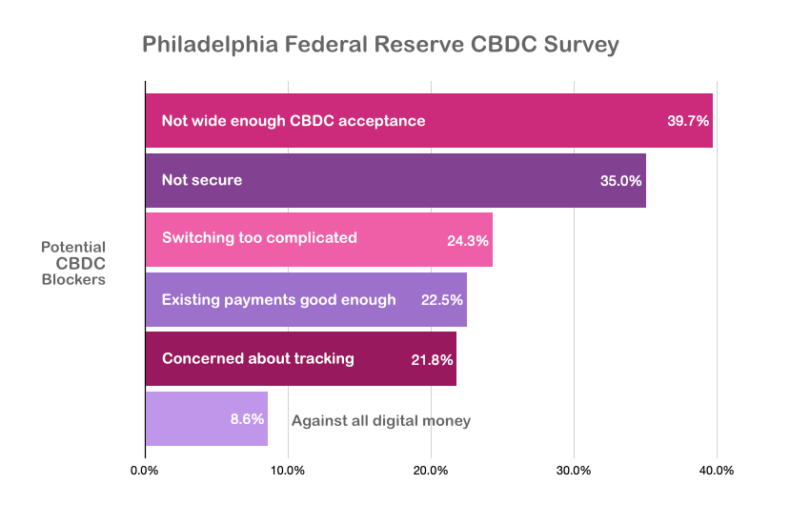

Another angle examined potential deterrents to CBDC adoption. Among six possible issues, privacy concerns were almost at the bottom, ranked fifth.

Regarding cross border payments, this ranked last as a feature priority, although almost 35% of warm respondents considered it desirable. Demographics impacted the response, with black (52%) and well-off respondents (55.1%) more interested in the option.

CBDC impact on other payment and storage methods

The survey also delved into how CBDC’s introduction might affect existing payment instruments and money storage methods. According to the Philly Federal Reserve researchers, the changeover is expected to significantly affect commonly used payment methods like cash, cards, and apps like Venmo or Zelle, while bank transfers are less impacted.

Regarding people switching to storing money in a CBDC, bank accounts are anticipated to be the most affected (37.6%), followed by cash (34.8%) and savings accounts (23.1%).

Meanwhile, in a recent paper the Federal Reserve examined the potential impact of a CBDC on the dollar’s dominance. Nevertheless, Federal Reserve Chair Jerome Powell has indicated that the introduction of a CBDC is not imminent.