Today enterprise blockchain firm R3 announced a partnership with Singapore startup OneHypernet. The new company is creating a netting solution for cross border payments which aims to significantly reduce the number of payments a company needs to make, saving payment costs – it claims by 96% – and shortening times.

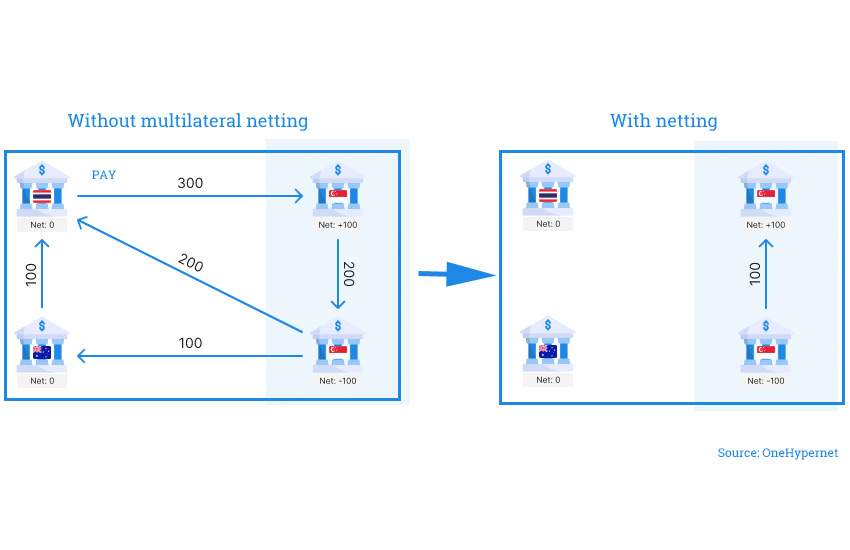

There’s a need for netting solutions for blockchain-based payments. Blockchain can enable instant settlement, but this can sometimes mean that more cash is required at one point in time. Consider two banks that make payments to each other bilaterally. If they settle every transaction as it becomes due, that will mean there are several payments in both directions. In contrast, if they agree to settle a net amount once a day, the final payment amount might be a fraction of the total payments.

In the case of OneHypernet, it’s not thinking about bilateral netting. It’s planning to net payments across numerous participating banks.

Netting is commonly performed by central counterparties such as CLS for foreign exchange traders. OneHypernet aims to do the same thing but in a decentralized manner. In order for it to work usually a central body would need to have visibility of all the planned payments. Instead, this decentralized solution will use confidential computing. That means companies will share their planned payments using R3’s Conclave, which works like a black box. Other parties can’t see the shared data used for the netting calculation, and it pumps out which net payments need to be made.

“The correspondent banking model is currently the only ubiquitous settlement solution for cross-border payments. As a system of bilateral relationships, operational processes and liquidity requirements are duplicated across the correspondent banking chain,” said Alstone Tee, Co-Founder of OneHypernet.

“Our partnership with R3 solves this by connecting global markets on a common ledger, enabling a real-time shared view with standardised protocols and data privacy. When privacy is preserved, all foreign exchange positions can be included in the same settlement cycle. This allows for a true multilateral, multicurrency settlement system, eliminating duplicative processes and liquidity costs. Through our network, we enable banks to unlock liquidity trapped in nostro/vostro requirements, perform faster pay-outs, and eliminate cross-border settlement risks.”

Apart from using Conclave, the solution will use R3’s Corda blockchain. The startup has a proof of concept grant from the Monetary Authority of Singapore and participated in the R3 Venture Development program, R3’s accelerator. OneHypernet was founded by the entrepreneurs behind the online money transfer business Thin Margin.

CLS has a blockchain-based netting solution CLSNet which deals with second-tier currencies not supported by its core CLSSettlement solution. However, the netting is bilateral. And in Japan, card payments firm JCB is working on a netting solution with LayerX, also bilateral.