Today the Reserve Bank of New Zealand announced plans to explore the potential for a central bank digital currency (CBDC) as well as issues arising from crypto-assets and stablecoins.

“Knowing that the money held in our bank accounts can be withdrawn in central bank money backed by the New Zealand government – currently only available through physical cash – is an unspoken promise which helps promote trust in banks and the financial system,” said Assistant Governor Christian Hawkesby.

He continued, “The potential for a Central Bank Digital Currency to help address some of the downsides of reducing physical cash use and services is something we want to explore for New Zealand. A CBDC, similar to digital cash, might well be part of the solution, but we need to test our assessment of the issues and proposed approach before developing any firm proposals.”

Prior to starting its CBDC exploration, today the Reserve Bank of New Zealand published a series of research reports examining the levels of cash use and payments preferences of its population. The central bank found that the COVID-19 pandemic has accelerated the decline in transactional cash use.

Prepared over the past six months, the cash use survey report found that almost half of New Zealanders (44%) are not concerned with a decreased availability of cash to pay for everyday things. It is also reporting an increase in the uptake of electronic payment options.

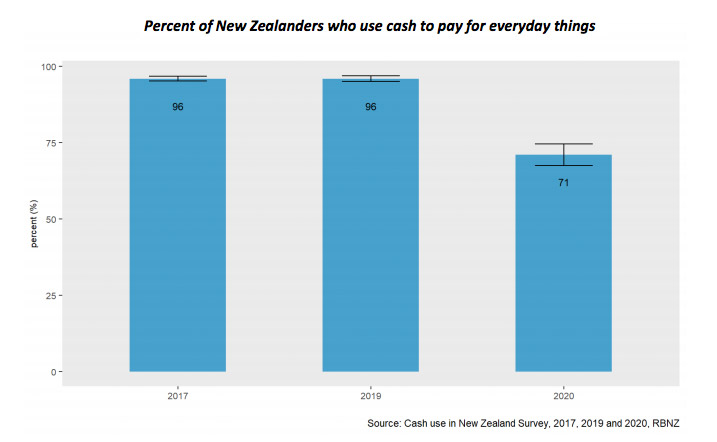

One of the report’s key findings was a marked fall in the use of cash. 96%, or almost the entire population, used cash to pay for everyday items in 2019 and 2017. In 2020, this fell to 71%.

Reduction in cash usage

As with many countries, the survey also found that certain age groups more than others preferred to pay in cash. Those over 60 years old made up 34% of the 9% that preferred to pay in cash in 2020, compared with the 18-29 year group, which only constituted 15% of the cash preference users.

This may prompt concern within the Reserve Bank that New Zealanders will lack access to state-issued money. Cash is a public good, so financial exclusion is a major problem.

Use of cash for store of value purposes

Another motive for a New Zealand CBDC might stem from the relatively similar attitudes toward using cash as a store of value. In 2020, 47% of the population stored cash somewhere other than in a bank. The figure was unchanged from 2019.

Rising popularity of digital payments

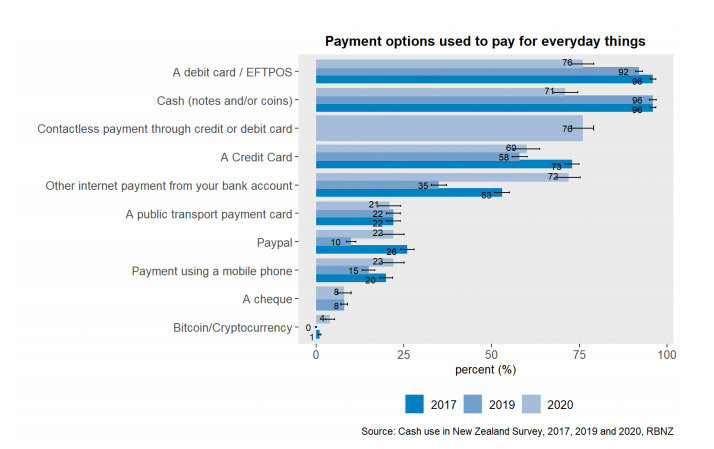

The document also reported a growing preference for methods of digital payment. In 2020, 33% of all New Zealanders used contactless as their main way of paying, and it is now the preferred method of paying for 36% of the population.

This statistic will likely encourage the Reserve Bank to increase its focus on developing a CBDC. As a digital form of physical cash, a CBDC will help to reduce the cost of handling physical cash, increase payment system efficiency and maintain the Reserve Bank’s relevance within the New Zealand monetary system.

However, New Zealand lags behind in the use of non-bank payment services. Although 76% of New Zealanders’ most often used a debit card to pay for everyday things, only 22% paid with a mobile phone or used a private payment service such as Paypal in 2020.

Promoting financial inclusion

Overall, the report found that the majority of New Zealanders (73%) said it was ‘very easy’ or ‘somewhat easy’ to withdraw cash when needed. However, 11% found it ‘somewhat difficult’ or ‘very difficult’ to get cash out.

Respondees cited access as the main reason, with 58% stating that it was difficult to withdraw cash because the ATM or bank branch was a long way from their home or work. The Reserve Bank will most likely respond to these findings by promoting digital innovations in money and payments.