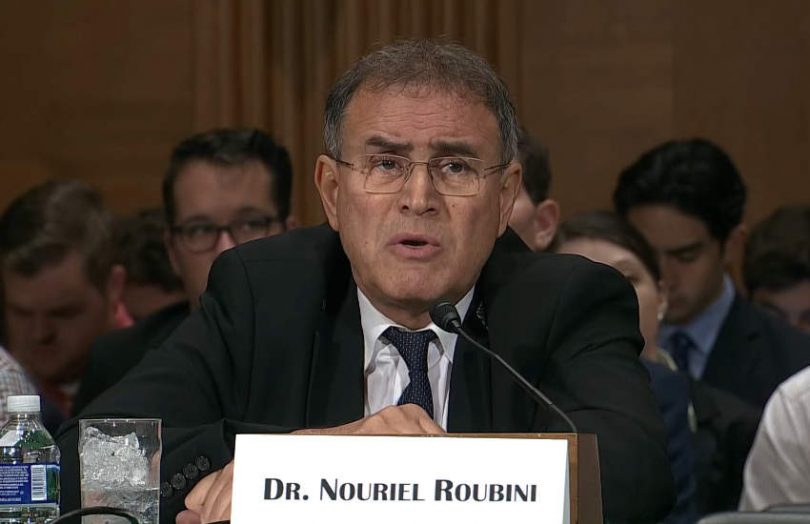

Nouriel Roubini, the outspoken economist with scathing views about Bitcoin and cryptocurrency, is working on a stable value asset that will eventually be tokenized. The co-founder and chief economist at Atlas Capital wants to develop an asset-backed United Sovereign Governance Gold Optimized Dollar (USG) to address a potentially devaluing dollar in the medium to long term as well as climate change, Bloomberg first reported. It is intended as a future means of payment and potentially a unit of account.

On Twitter, Roubini said, “USG will be first an index, then an ETF & last a security token backed by real/fin assets with AML/KYC features. Hedge against inflation, pol/geopol risks; & with ESG features.”

The Facebook-founded Libra (Diem) stablecoin project raised concerns with central banks about becoming a widespread means of payment. The original incarnation of Libra intended to use a basket of currencies to provide a semblance of international currency stability. There’s more than a conceptual similarity between Libra and USG. For the blockchain aspect, Atlas has partnered with Mysten Labs, where the leaders are from Novi, the Facebook (now Meta) wallet subsidiary that was tasked with working on technology to support Diem, before the project was abandoned.

A future USG token will be backed by U.S. Treasuries, gold and real estate investment trust (REIT) assets. The real estate aspect is intended as an inflation hedge, although since the mid-1980s, the correlation between inflation and house prices has been weak. Some claim because of a measurement issue. However, falling inflation and interest rates can make mortgages more affordable (and vice versa), which could support why there has been some negative correlation in recent years.

Despite his criticism of crypto, Atlas and Roubini see a digital future for money, but most likely central bank digital currencies (CBDC). However, there’s a reasonable possibility that a U.S. CBDC will be subject to a potential medium to long-term devaluation of the dollar. Atlas cites three risks of this happening as inflation, government and current account deficits, and geopolitical currency competition.

Hence the plan to offer an interest-bearing alternative.