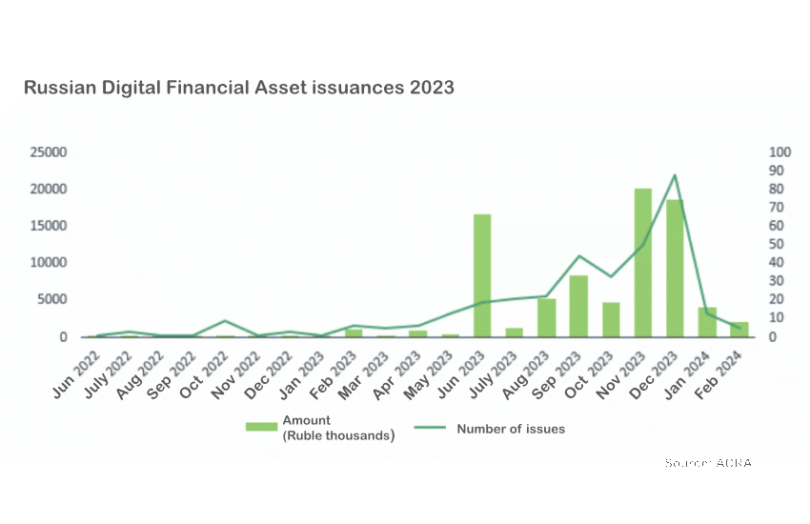

In 2021 Russia passed legislation supporting the tokenization of real world assets (RWA), calling them digital financial assets (DFA). It took a while for the central bank to authorize issuing platforms, with a trickle of issues in 2022 (perhaps three). However, in 2023 it started to take off with ten licensed entities. A recent report by rating agency ACRA estimates there were 350 issues in 2023, with an outstanding balance of around 60 billion rubles ($651 million). Russia’s largest bank Sber said it issued more than 30 DFAs by mid-2023.

“It is difficult to recall any financial instrument in the last ten or fifteen years that has shown similar growth rates in such a short period of time,” ACRA wrote. That’s despite significant restrictions on which asset classes can be tokenized and which investors can participate.

We believe that currently investors are mainly restricted to corporates and wealthy individuals. Other consumers can invest but only in certain types of assets and they have monetary limits. Institutional investors are excluded.

Around 25% of issuance instruments are for three months or less duration. ACRA described the most popular DFA as a “certifying monetary claims against the issuer,” which we interpreted as commercial paper. We’ve previously reported Russian DFA issuances that tokenized trade finance assets, commodities, real estate and slightly more complex instruments.

Why ACRA believes banks will dominate tokenized assets

So far the central bank has authorized ten DFA platforms, including Russia’s largest bank Sber and Alfabank. ACRA believes banks will dominate because they have large customer bases who are potential investors. Additionally, they have access to corporate borrowers who are likely issuers.

Small and medium-sized (SME) firms are most likely to issue DFA tokens. Larger issuers are fine accessing bond markets, and currently the DFA investor base is too restrictive for a large corporation. Plus, DFAs cannot yet be used for repurchase agreements (repo). Additionally, while the Moscow Exchange was granted a license as a secondary market, it is still integrating solutions. Bigger issuers will need a secondary market.

ACRA suggests that larger platforms will focus on simpler instruments that are easy to scale, leaving smaller tokenization solutions to target more complex products.

The central bank has deliberately kept the investor base and the range of investment instruments restricted to prevent the market from growing too fast. ACRA’s conservative view is that DFAs could remain a niche product. Its more optimistic prediction is it could compete with short term bank borrowing. It estimates the volume of assets in circulation could grow to 250 billion rubles by the end of 2025. At that point, it expects the central bank to relax some of its rules.

The use of DFAs for trade might not be easy

Earlier this week we reported that Russian legislation was progressing to support the issuance of DFAs as tools to settle cross border trade transactions. This might be tokenized gold or other commodities. Regulators view this as a tool to address sanctions that make settlement tricky.

However, ACRA sees a significant number of technical challenges. Non-resident suppliers and buyers would have to be onboarded and open Russian bank accounts. One option might be to create “an international exchange operator capable of connecting Russian information systems with foreign platforms.” In other words, ACRA doesn’t see this as a quick fix.