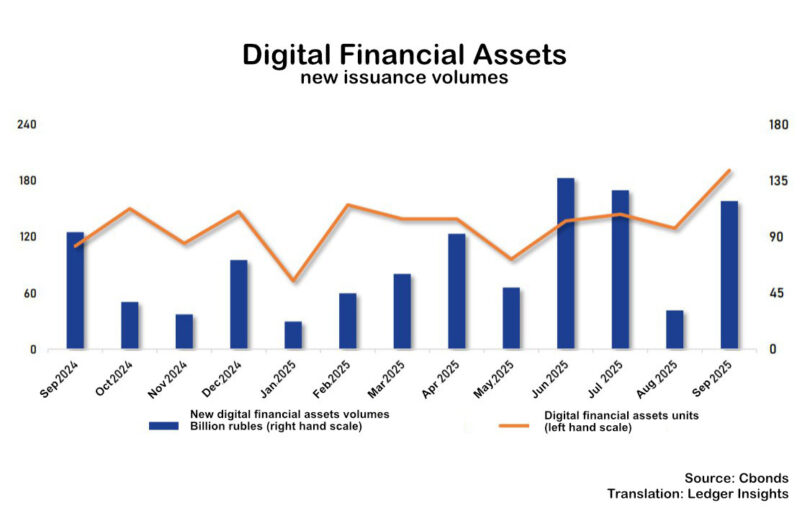

The issuance of Russian digital financial assets (DFA) reached 119 billion rubles ($1.5 billion) in September 2025. DFAs are digital assets issued by real world asset (RWA) tokenization platforms under central bank oversight. The September figure was dominated by Russia’s largest bank, Sber, issuing 77 billion rubles (almost $1 billion) across 39 issuances.

Development bank VBRR issued 12 billion rubles, with state-owned PSB issuing 10 billion rubles. There are two notable aspects to DFAs. Firstly, there are a large number of tokenization platforms, which has led to poor liquidity, resulting in most issuances having short term durations. That means the top line issuance figures may be exaggerated as many of the assets may be rolled over. This is relevant as a learning experience for other jurisdictions.

The second notable aspect is particular to Russia. While DFAs initially were not allowed to be used as payment instruments, in early 2024 Russia passed a law enabling DFAs to be used for sanction-busting cross border payments. What’s unclear is the proportion of the volume that is being driven by this cross border demand, but evidence suggests sanction evasion is a driver.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.