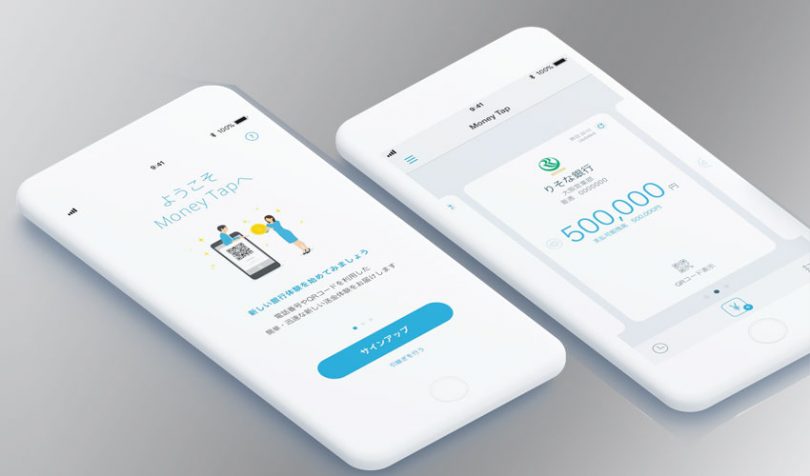

Today SBI Ripple Asia, the joint venture between Japanese group SBI (60%) and Ripple (40%), launched their Money Tap app in the IOS and Google Play app stores. The application is for both cross-border payments and domestic Japanese payments. Last week they received a licence for electronic payments. More than sixty banks are part of the consortium.

In Japan, bank transfers are only possible during limited hours. Hence the application enables 24/7 banking.

The banks that are live are Shumishin SBI Net Bank, Suruga Bank, and Resona Bank. For now, there are no fees from the first banks, but each bank is free to set their own fees.

As for any conventional transfer, the bank account of the recipient is needed. However, it’s also possible to use a mobile phone number and QR code if the recipient has the app because they can set their default bank account for receiving funds. The app also uses fingerprint biometrics to balance user experience and security.

The solution leverages Ripple’s xCurrent protocol. This is a bi-direction messaging protocol, compared to conventional SWIFT which is single direction. It does not require the use of XRP. That compares to Ripple’s xRapid protocol which leverages the digital asset and removes the need for correspondent accounts between banks.

Parent company SBI Holdings has several blockchain related activities and also started piloting its S Coin virtual currency last week. It owns cryptocurrency exchange, SBI Virtual Currencies, and has a stake in enterprise blockchain firm R3.