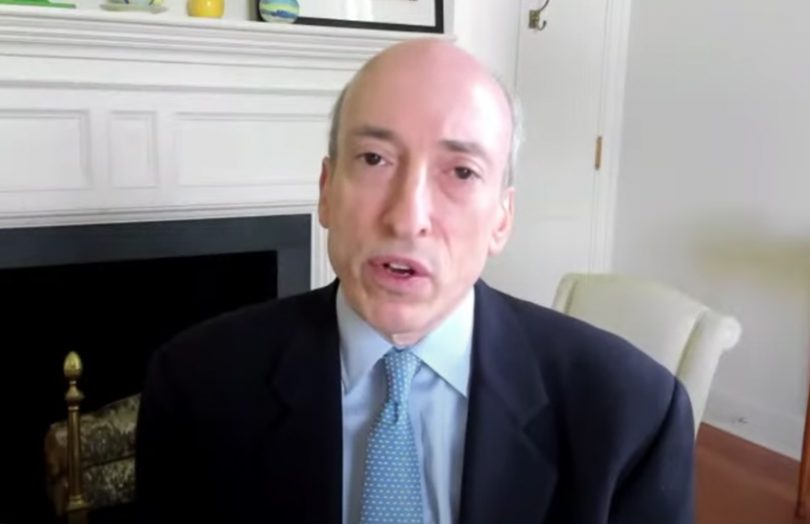

At today’s Aspen Security Forum, Security and Exchange Commission (SEC) Chair Gary Gensler outlined what he sees as the priority areas for cryptocurrency legislation.

“In my view, the legislative priority should center on crypto trading, lending, and DeFi platforms,” said Gensler. He’s particularly concerned about the current lack of investor protections and worries that people will get hurt.

To summarize Gensler’s positions:

- The vast majority of crypto assets are securities. The SEC Chair believes the SEC has been very clear on that for years. Hence will continue to pursue enforcement on token issuance

- Exchanges, platforms trading securities need to register with the SEC

- Gensler is keen for Congress to help establish regulatory guard rails for crypto trading, lending, and DeFi platforms

- Other areas that the SEC is looking into are stable value coins, custody and ETFs. For ETFs the focus is on those linked to CME listed Bitcoin futures.

Most crypto assets are securities

The SEC will continue to take action where it sees securities sales. Gensler believes most crypto assets and hence token issuances are securities. Talking about the Howey Test, he said, “Did you give somebody money in anticipation of profits, on their efforts. Usually, there’s a handful of people at the center of XYZ project.”

He continued, “and in effect, the investor is hoping those people do well. That means anticipation of profits on the efforts of others. I think it’s reasonably clear. I would say very clear.”

And hence the SEC will continue to use its enforcement authority. “A lot of this is clearer than some of the entrepreneurs would like to think,” he added. “I think that (former SEC Chair) Jay Clayton was pretty clear three and half years ago.”

When asked about why Ethereum is seen as having a free pass, he refused to be drawn on any particular case in deference to his new head of enforcement. For context, back in 2018, an SEC executive stated that Ether is not currently a security. However, the 2018 pronouncement qualified that by saying, “putting aside the fundraising that accompanied the creation of Ether.”

Most exchanges, platforms are hosting securities

The ‘platforms’ such as cryptocurrency exchanges where crypto assets are traded are likely trading securities. Gensler made the point that if there are only a handful of crypto assets being traded on the platform, then there’s a possibility that they might not qualify under the Howey Test. However, given most tokens are securities, if a platform supports 25 plus tokens, there’s a pretty high probability that at least some of those tokens are classed as securities.

“I encourage those platforms to come in and talk to us. Register. (The) probabilities are you’ve got securities on your platforms,” he said.

However, he does believe the regulations need to be tweaked by Congress for platforms. “Regulators would benefit from additional plenary authority to write rules for and attach guardrails to crypto trading and lending,” said Gensler during his opening remarks. He specifically included Decentralized Finance (DeFi) platforms.

Stablecoins, custody and ETFs

The SEC Chair also talked about stablecoins. Because they are used in most crypto asset trades, he sees the potential to sidestep anti-money laundering and tax compliance procedures. “Further, these stablecoins also may be securities and investment companies,” said Gensler.

Additionally, the SEC has workstreams on custody and funds and expects to see filings for ETFs invested in CME Bitcoin futures. Most ETFs have been rejected because there are concerns over price transparency and manipulation. Reading between the lines, the SEC is more likely to give the green light if an ETF is based on a regulated derivative.

Meanwhile, one of the cryptocurrencies currently battling the SEC in court is Ripple. Its CEO Brad Garlinghouse will participate in another Aspen panel tomorrow.