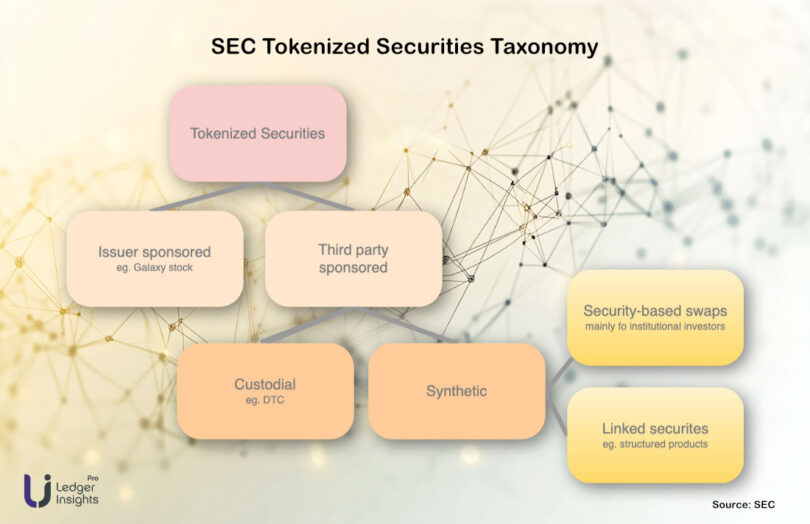

A major part of the Securities and Exchange Commission’s (SEC’s) current agenda is how to enable the tokenization of securities in a manner that embraces innovation but doesn’t compromise US markets. As part of this effort, the SEC yesterday announced its categorization framework for tokenized securities, providing clarity on registration requirements based on structure rather than addressing ongoing debates about disclosure and nomenclature for synthetic products. The taxonomy has significant implications for which products can be offered to retail investors under current securities laws.

The SEC divided tokenized securities into two primary categories: issuer sponsored and third party sponsored. Issuer sponsored securities provide token holders with actual rights to the underlying securities. For listed securities, this occurs when a digital transfer agent tokenizes securities on the blockchain, while for private issuances, the issuer can choose to handle tokenization directly. The Superstate tokenization of Galaxy stock exemplifies this approach for listed securities.

Third party sponsored securities were further subdivided into custodial and synthetic categories. The recent no action letter granted to the DTC represents custodial tokenization, which provides full rights in the stock to token holders. The synthetic category presents more complex regulatory considerations, with several companies including Backed (xStocks), Robinhood and Ondo Finance which have issued these types of tokenized securities outside the United States.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.