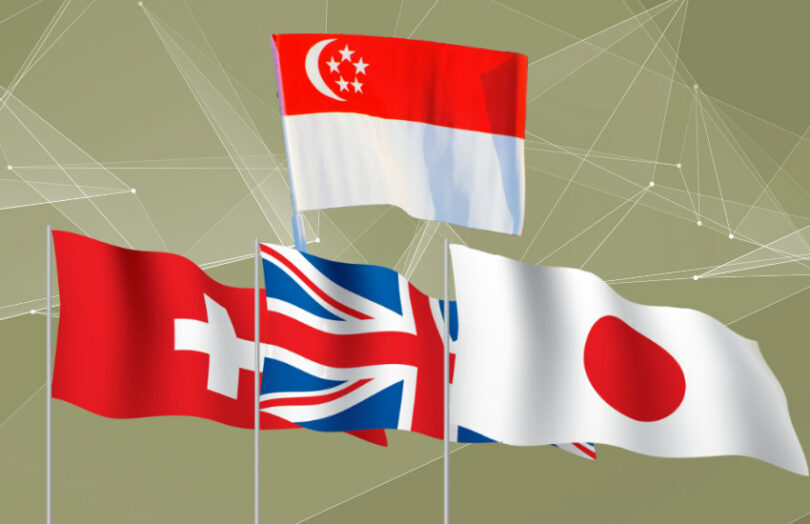

The financial regulators from England, Switzerland and Japan are joining Singapore’s Project Guardian, which is already on its second iteration. The initiative explores digital assets and tokenization using public blockchain with financial institutions and the BIS Innovation Hub. The current focus is on fixed income, foreign exchange (FX) and asset management.

The Monetary Authority of Singapore (MAS) previously said the Japan Financial Services Agency (JFSA) was participating, given the first iteration included Japanese government bonds. UK asset manager Schroders is one of the participants, so the addition of the UK’s Financial Conduct Authority (FCA) makes sense.

“The UK’s asset management sector – which is the second largest in the world – sees significant potential in the use of distributed ledger technology to drive innovations, efficiencies, and enhanced value for customers,” said Sarah Pritchard, Executive Director of Markets and International at the FCA. “We look forward to working with our global partners to examine the market benefits, regulatory challenges, and industry use cases of asset and fund tokenisation.”

As part of Project Guardian, we recently reported UBS Asset Management’s tokenization of a money market fund. Hence, it makes sense that FINMA also joined.

UBS might not be the only focus of FINMA’s involvement. One of the Project participants is Japan’s SBI Digital Asset Holdings. Together with Switzerland’s SIX stock exchange, it co-owns Singapore-based AsiaNext. And AsiaNext is planning to enable digital asset trading, providing global liquidity.

Why multiple regulators?

All three of the Project Guardian focus areas have an international dimension, with FX being the most obvious. Public blockchains are borderless by nature. In contrast, if fixed income securities are traded across borders, in traditional finance (TradFi) that usually involves interlinking the domestic central securities depositories (CSDs) with the buyer’s CSD.

Meanwhile, MAS said the policymaker group will discuss legal, policy and accounting issues for digital assets, aiming to plug any gaps. They will also look at standards, including interoperability. Plus there’s the potential for pilots in regulatory sandboxes in the other jurisdictions, ‘where applicable’.

In June we reported the involvement of 11 financial institutions in Project Guardian, but the figure is now 15.