Most of the arguments about whether third parties should be allowed to offer stablecoin yield/rewards have been about the impact on bank deposits and the perspective that banks currently deprive consumers of yield. The democratizing yield argument doesn’t really stand up to scrutiny. Onchain yield is available today via tokenized money market funds (MMFs). In six months time when tokenized assets are more widely available, consumers will be spoilt for choice, including access to tokenized MMF ETFs. At some point pure tokenized Treasuries could be available.

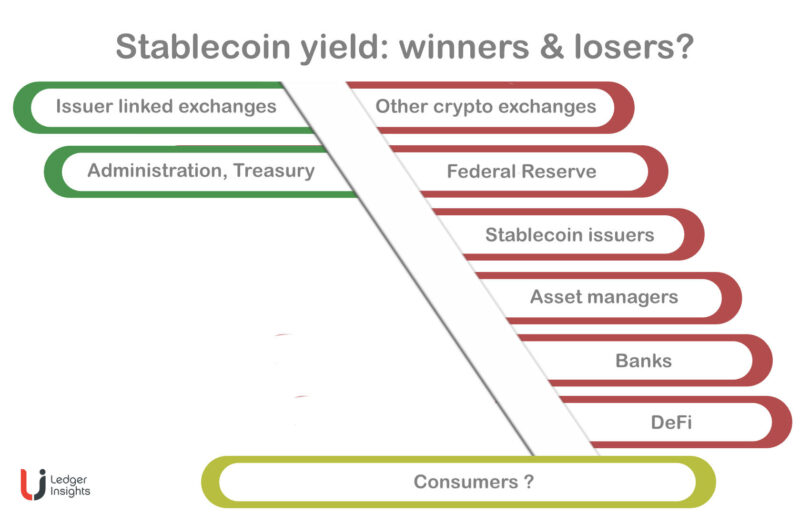

There are numerous other perspectives on the yield argument, including how it will impact money market funds, whether yields will lead to stablecoin transaction costs, and how it fits in with the US administration’s goals to influence monetary policy. Even more importantly: what about the consumer? The core issue is that yield sharing accelerates convergence between stablecoins, tokenized money market funds, and deposits, but this convergence may undermine rather than enhance stablecoin utility. The following analysis demonstrates there are potentially more losers than winners.

From a consumer perspective, what’s the benefit of stablecoin yield over a tokenized MMF? Stablecoins and tokenized MMFs already overlap economically. Both are backed by short term Treasuries. With yield, that similarity becomes visible to users. The main difference is access: tokenized MMFs require KYC for each holder, while stablecoins only require it at exchange on-ramps. But users already provide KYC to crypto exchanges, and as onchain identity infrastructure develops, even this minimal friction disappears. What consumers gain from stablecoin yield is marginal convenience. What they potentially lose is zero cost stablecoin transfers if yield sharing eventually forces stablecoin issuers to charge for transfers. This makes the yield discussion less about consumer benefits than competitive positioning among intermediaries.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.