Earlier this week, U.S.-based asset management firm

State Street published a report on 2020 industry trends, which sees growth in digital assets and blockchain for financial markets.

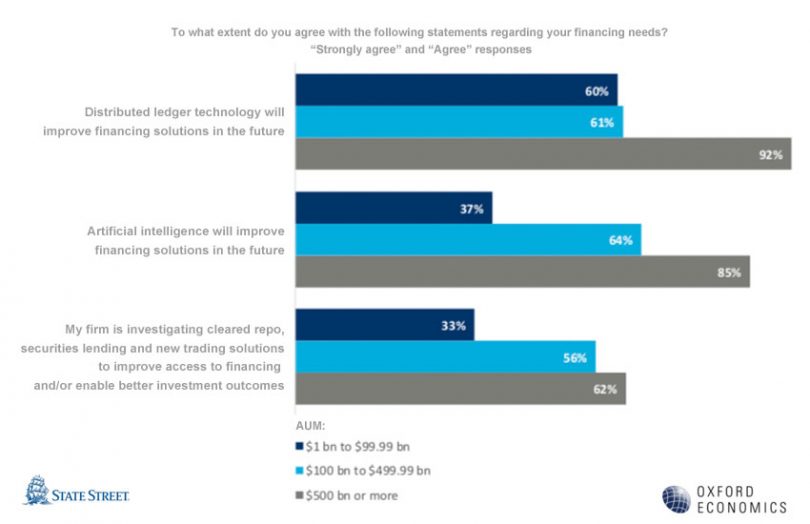

The report is based on a survey of 101 North American asset managers with an emphasis (71%) on those with more than $100 billion in assets under management (AUM). About 65% of the respondents agreed or strongly agreed that distributed ledger technology (DLT) is likely to improve future financing solutions. But in the case of larger asset managers, with more than $500 billion under management, the figure was 92%. That said, large asset managers only made up 13-14 of the people surveyed.

And 62% said DLT would be integrated into their trading process in 2020.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: State Street