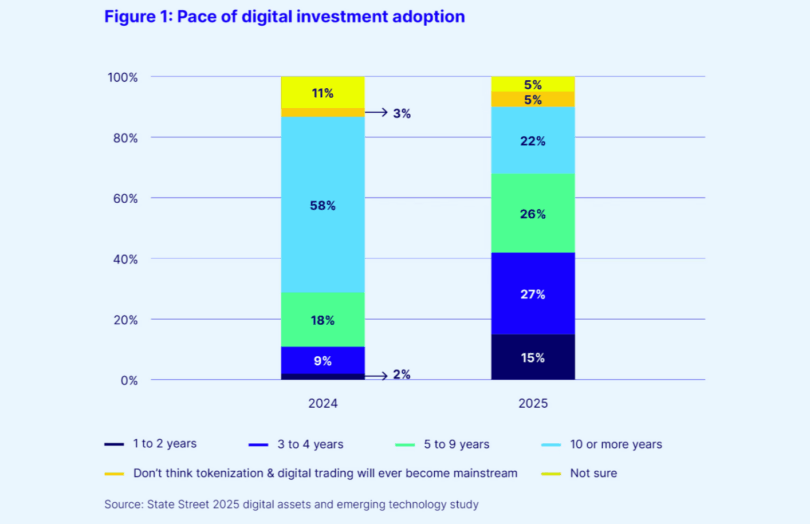

New State Street research found a big increase in expectations regarding digital asset adoption. In last year’s survey 29% of respondents believed digital investments, including cryptocurrencies and tokenization, would go mainstream within ten years. This year the figure has jumped to 68%. Around 42% expect to see mainstream adoption within five years, up from 11% in the 2024 survey.

That adoption readiness is reinforced by forty percent of respondents already having dedicated digital asset teams.

By 2030, just over half of respondents envision that between 10 and 24% of all investments will involve digital assets or tokenization. Currently stablecoins and tokenized real world assets make up the largest portion of digital asset portfolios. However, the survey found that the majority of returns are coming from cryptocurrencies. In the longer term, respondents expect private assets to be the primary beneficiaries of tokenization

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.