With the shuttering of Silvergate, Silicon Valley and Signature banks in less than a week, there’s plenty of analysis about what went wrong. The triggers boil down to five factors: rapid deposit drawdowns, weak risk management, cryptocurrency, interest rates and an accounting issue that had a major impact on Silicon Valley Bank’s (SVB) situation. SVB was arguably bust months ago.

Silvergate went first, but it was an orderly shutdown. Through conservative risk management, it endured a run on the bank in the fourth quarter. But it continued to suffer losses on its sale of government bonds. Last week it decided to close voluntarily without the need for FDIC insurance. It stated the shutdown was “in light of recent industry and regulatory developments.”

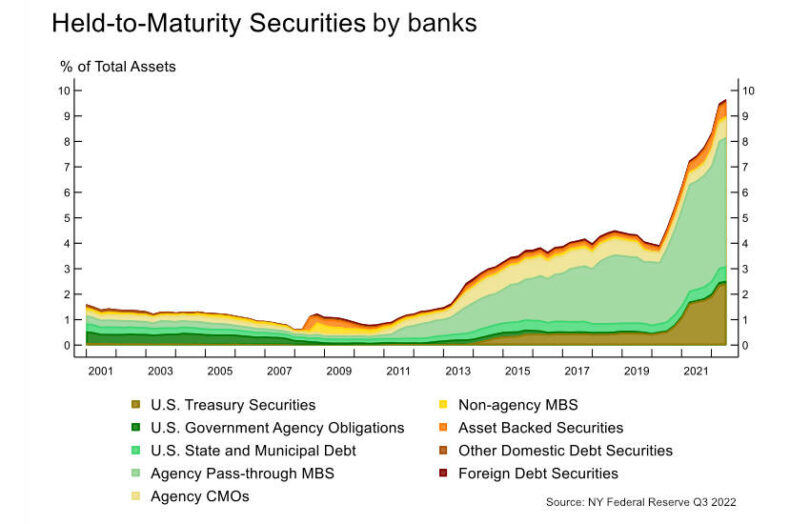

SVB’s demise was largely due to timing related to Silvergate’s shuttering and pattern recognition by SVB clients causing its run. So the impact of cryptocurrency was indirect through Silvergate worries. However, by some measures, SVB was insolvent by the end of Q3 2022.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.