Today the Bank for International Settlements (BIS) Innovation Hub published a report on Project Inthanon-LionRock Phase 2, the cross border central bank digital currency (CBDC) project between the Bank of Thailand and the Hong Kong Monetary Authority (HKMA). Following on from Phase 2, the People’s Bank of China (PBC) and the Central Bank of the UAE have joined the initiative for Phase 3, now known as the mCBDC Bridge project.

However, the Phase 2 report said three central banks were involved, without mentioning the third bank. Clearly, HKMA and PBC have a close relationship.

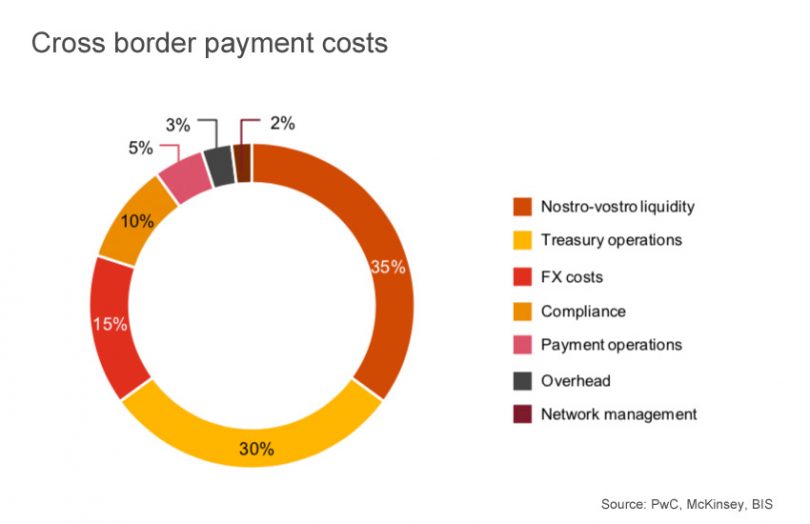

The report concludes that the project can significantly reduce cross border payment costs. At the same time, it found some areas that need further exploration, including privacy for PvP transactions, optimizing liquidity savings, and scalability.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.