A recent stablecoin survey of banks, fintechs, and crypto-native firms found that speed of execution was the single largest benefit of stablecoin payments, trumping cost savings. Fireblocks, the crypto custody, wallet and infrastructure provider, conducted a stablecoin survey of almost 300 firms in March. The company’s CEO also revealed that payment firms were its largest growing segment, and their activity outstrips that of crypto native clients.

Forty-nine percent of the respondents to the stablecoin survey are already using stablecoins, with 41% planning or piloting their usage. The two most notable takeaways from the survey were the motivations and regional differences.

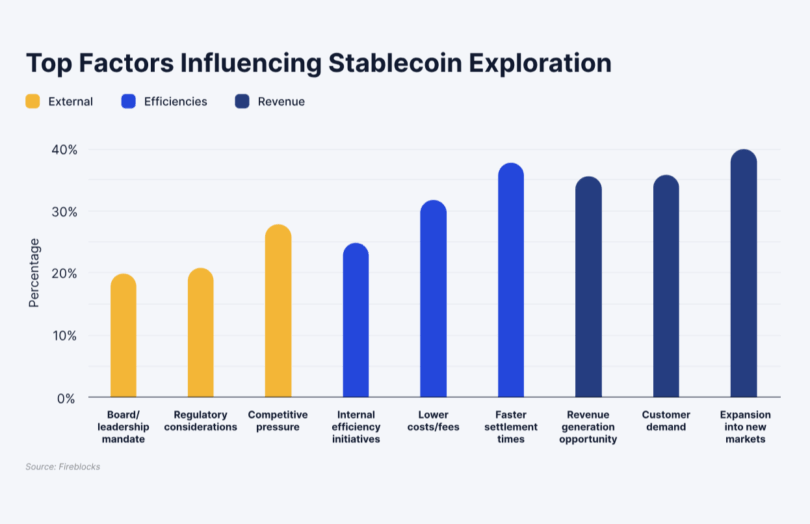

The graphic above shows that revenue opportunities are the largest source of demand, often enabling expansion into new markets or to respond to customer demand. We have no idea whether Stripe has a relationship with Fireblocks, but it is a perfect example of entering new markets. When Stripe launched its stablecoin accounts, we observed that many of the 101 jurisdictions in which the accounts are available represent untapped regions for the payments firm. While Stripe maintains a high profile, its operations have primarily focused on North America, Europe, and select larger economies elsewhere, showing minimal overlap with their new stablecoin offerings.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.