Tokenise Europe 2025 aims to drive the adoption of tokenization to make the European Union a frontrunner in the sector and protect its sovereignty. It was founded by the European Commission in conjunction with the Association of German Banks, with consultancy Roland Berger providing support.

So far, 20 firms have joined the association, with Germany, Spain and Liechtenstein leading the charge. Four global banks are involved – BBVA, Commerzbank, Deutsche Bank and Santander – plus a handful of large industrial companies such as Daimler Trucks, Renault and Repsol. In addition to the German banking association, its counterparts from Italy and Liechtenstein are involved as well as payment firms Iberpay and Worldline.

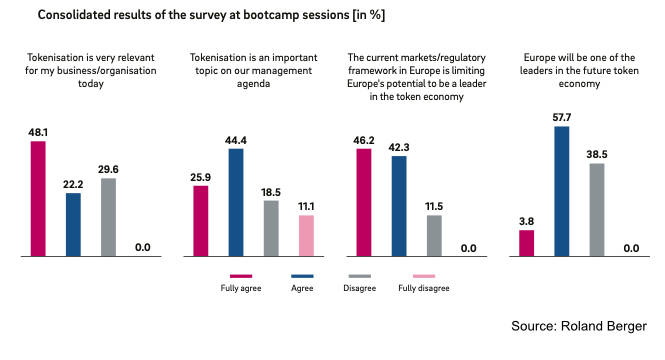

Roland Berger ran a survey on tokenization, although it acknowledged the results published in January are not necessarily representative. It found that two thirds believe tokenization is relevant to their organizations, and half believe Europe will become a leader.

Tokenization challenges

At the same time, it identified three issues it believes are holding Europe back. Firstly, tokenization is seen as a long term bet rather than delivering immediate benefits. This means that corporates prioritize funding towards other initiatives with a faster payoff.

Secondly, Europeans have a tendency to be overly conservative and risk averse, combined with a dose of skepticism. They’re more comfortable with currently used mature technologies.

This leads to the third challenge, which is the need for education. Relatively few people appreciate the potential benefits of tokenization and blockchain beyond cryptocurrencies.

Despite European legislative progress such as the MiCA crypto-assets legislation, which is close to being passed and the DLT Pilot Regime coming into force in March, the consultants call for more supportive regulations. It cites an example of German banks’ inability to process secure machine-to-machine (M2M) payments under current laws.

Tokenization opportunities

On the flip side, the report sees tokenization as driving Industry 4.0. Reducing the need for intermediaries provides enormous efficiency benefits and the potential for new business models.

Industry 4.0 includes the automation of supply chains and trade finance, with today’s report on Commerzbank and T-Systems as an example.

Tokenization will also drive many of the opportunities in the emerging metaverse, and Europe is home to several major sports companies. For example, Adidas has the potential to make significant income from digital footwear and apparel.

Ledger Insights has extensively covered the potential benefits of tokenization in finance, with huge cost savings, efficiencies, and new sources of revenue.

The report concludes: “While some awareness has been created, tokenisation is still widely held to be a medium- to long-term development. Currently, we see no stakeholders standing up to become first movers in taking Europe’s token economy to the next evolutionary phase.”