Twelve banks that are part of the R3 consortium are working on a project to digitize Letters of Credit. Historically Letters of Credit, while used by companies of all sizes, are more widely used by larger companies because they’re somewhat cumbersome to deal with.

It’s conceivable by making them quicker and easier, the penetration amongst companies of all sizes could increase. Today 40% of trade finance uses Letter of Credit, but the market share is declining.

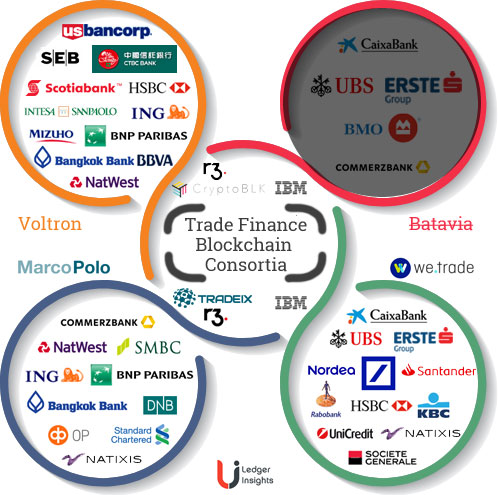

The consortium unveiled a proof of concept in August last year using R3’s Corda technology. To move things along a bit quicker, HSBC took the shared code and developed it further working with Hong Kong technology company CryptoBLK. That enabled them to run the recent pilot with Cargill and ING which demonstrated that you could cut the time for paperwork from 5 – 10 days to just one day.

The next stage of adding new features to Voltron will be developed jointly with the rest of the banks.

Joshua Kroeker who heads up Blockchain and DLT for trade finance at HSBC believes you need to have a central organization and this is the biggest task to reach production. He said, “you need to make sure it’s a neutral party, and we’ll need that in Voltron”. HSBC is also a shareholder in we.trade, which incorporated as a joint venture. For now, R3 acts as the glue for Voltron.

The banks involved are Bangkok Bank, BBVA, BNP Paribas, HSBC, ING, Intesa, Natwest, Mizuho, Scotiabank, SEB, CTBC, and U.S. Bancorp.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.