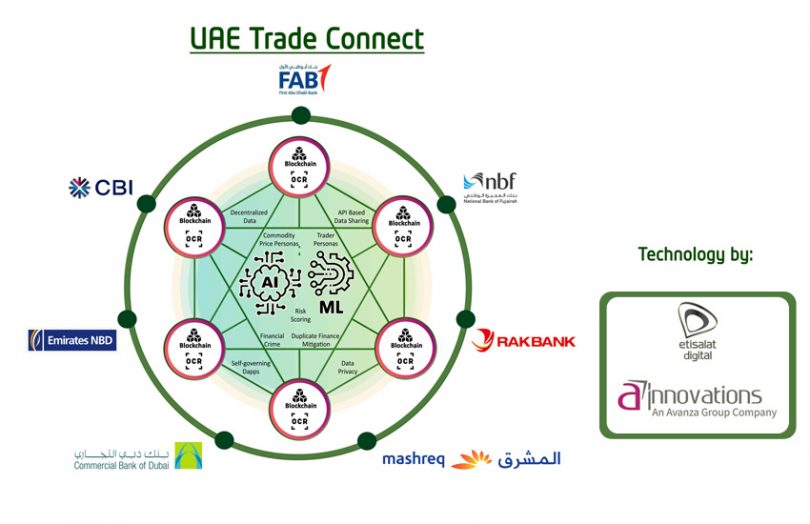

On Tuesday, UAE Trade Connect (UTC) held a press conference for the production launch of the trade finance blockchain system. The network was first announced in mid-2019 by Etisalat Digital and First Abu Dhabi Bank (FAB) with Avanza Innovations as the developer. There are now seven banks that all participated in the platform’s development and another four banks are starting pilots.

While there was a little reluctance to provide specific figures about the solution’s potential, it’s possible it could process 200 – 250 billion dirham of domestic trade ($55-$68 billion) annually.

The founding banks are First Abu Dhabi Bank, Emirates NBD, Commercial Bank of Dubai, Mashreq, National Bank of Fujairah, RAKBANK and Commercial Bank International and the central bank has been on the steering committee since 2020. With 48 banks in the UAE, it hopes to become a national network with international banks participating.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.