In two or three years, mainstream stock exchanges like the

ASX and

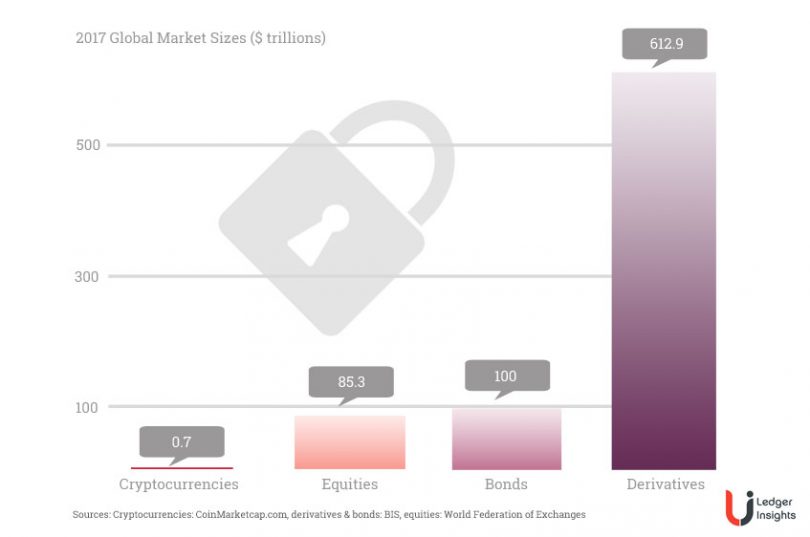

SIX will be using blockchain and distributed ledger technology (DLT) for settlement. With global equity markets alone amounting to $85 trillion of assets, the security of the cryptographic keys that control these digital assets is paramount. London-based startup Trustology plans to meet that security need by providing an institutional grade safeguarding solution.

Trustology is currently a spoke of Consensys, but it’s in the process of being spun out into a separate entity. Trustology founder and CEO Alex Batlin joined from BNY Mellon and previously worked at UBS. During his stint at UBS he was part of the team that conceived the Utility Settlement Coin, the institutional “stable coin” where collateral is held at central banks. Trustology’s leadership team previously worked at RBS, Barclays, UBS, JP Morgan, Nomura, and, most recently, BNY Mellon, the world’s largest custodian bank.

Addressing a pain point

Scalability and security are two of the main technical barriers to enterprise adoption of blockchain and DLT. Last week the

DTCC announced that two protocols, Digital Asset’s and R3’s Corda are capable of supporting stock settlement transaction rates that are sufficient to support the DTCC’s needs at 6,300 per second.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: Composite Ledger Insights