Today Stripe announced that certain Twitter creators can now receive payments to a cryptocurrency wallet in the form of the USDC stablecoin on the Polygon network. This is one of the most high profile steps for mainstream stablecoin payments.

USDC issuer Circle originally targeted its stablecoin to be used for mainstream payments, but in the last 18 months, it has gained a reputation as the DeFi stablecoin.

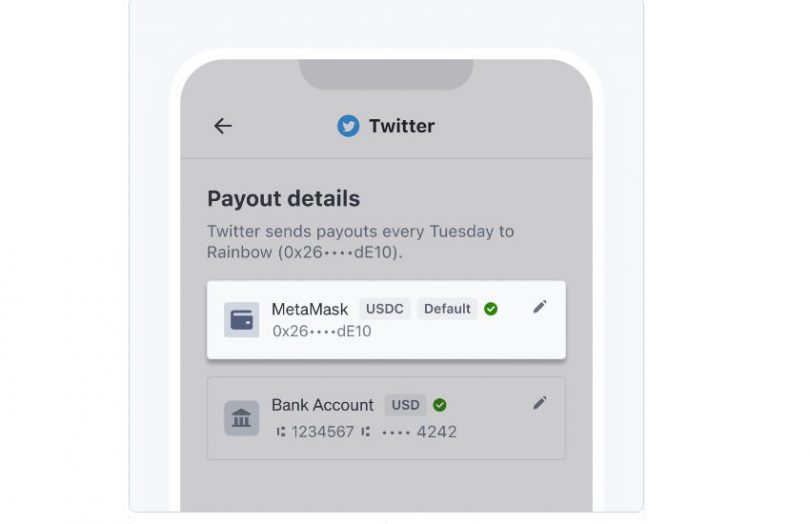

Twitter enables creators to earn money through Ticketed Spaces and Super Follows. These users can now opt to receive their money in cryptocurrency, with Stripe handling the “crypto-related complexity”. Polygon, an Ethereum sidechain was chosen because of its low fees and compatibility with popular wallets such as MetaMask, Coinbase and Rainbow.

Stripe says it plans to add other networks and cryptocurrencies.

“We’re focused on helping creators who drive those conversations earn money and connect with their audiences in new ways,” said Esther Crawford, Product Lead for Creators, Twitter. “We’re excited to begin offering crypto payouts to creators via Stripe so they have more choice in how they get paid.”

Last month Stripe launched services that targeted crypto businesses such as exchanges, wallets, and NFT marketplaces.

In another move towards the mainstream, earlier this month, credit card processing firm Worldpay announced that merchants could receive their funds in USDC. BlackRock also recently invested in Circle to explore stablecoins for capital markets.

These sorts of Twitter and Worldpay payouts could be particularly attractive for people outside of the United States if it helps them save on exchange rate costs. It could encourage some to keep more money in U.S. Dollars, especially if they use dollars to pay any remote team members.

However, many people who don’t live in the U.S. would need to convert into local currency to meet regular expenses. Stablecoins in other currencies have not yet taken off. For example, the largest Euro stablecoin has a market capitalization of just over $222m, compared to around $150 billion for fiat-backed USD stablecoins.

That’s because most stablecoin demand is related to cryptocurrency transactions which tend to be denominated in dollars. Mainstream adoption could impact demand for stablecoins in other currencies.