Last night Bloomberg reported that the UK’s Economic Secretary to the Treasury, Bim Afolami, said the government is pushing hard for crypto-asset legislation covering stablecoins and staking. A UK general election is required in less than a year, which could disrupt the timing.

Talking at a Coinbase-hosted event, Afolami said, “We’re very clear that we want to get these things done as soon as possible. And I think over the next six months, those things are doable.”

In November, the Bank of England and the Financial Conduct Authority (FCA) launched late-stage stablecoin consultations, which recently closed. We reported on feedback from industry associations AFME and UK Finance. The thinking on these topics is quite advanced, so the timetable is unsurprising.

Staking crypto-assets

Carving out staking versus other crypto-asset topics results from responses to a consultation published last November. Stablecoins were always planned for phase 1 legislation. However, respondents said staking was a higher priority than other topics.

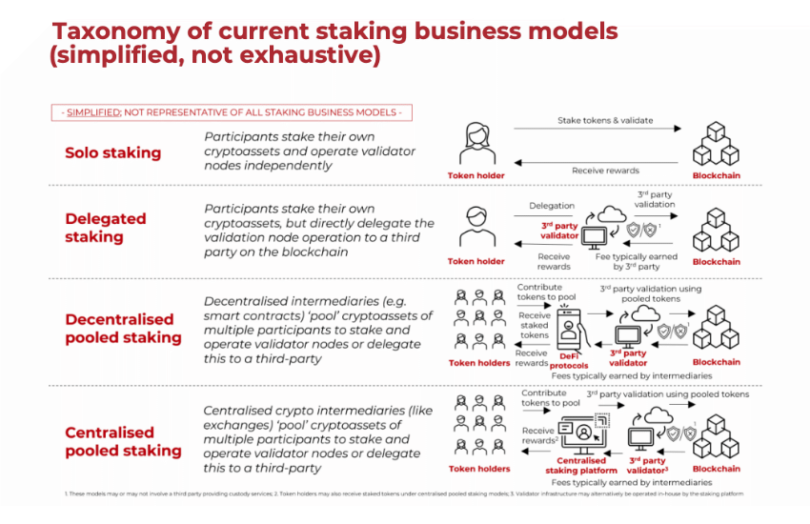

As part of that November paper, the government outlined its thoughts on staking. First off, it noted that staking is a loosely used term. It was initially known as locking up cryptocurrencies for validating transactions on a layer 1 proof of stake (PoS) blockchain. However, other token issuers use the term staking for different functions. If staking doesn’t directly facilitate the validation of a PoS blockchain, it won’t be classed as staking.

Some of the activities in the diagram above might be captured by other regulatory regimes relating to financial promotions, custody, lending and intermediation. These will address the significant consumer risks.

HM Treasury noted that potentially staking services provided by intermediaries could be classified as collective investment schemes. However, the government plans to prevent that from happening with a carve-out. It said it may introduce regulations for “operating a staking platform”.

Meanwhile, the UK has moved quite quickly on other fronts that are more straightforward. For example, it launched the Digital Securities Sandbox in March.