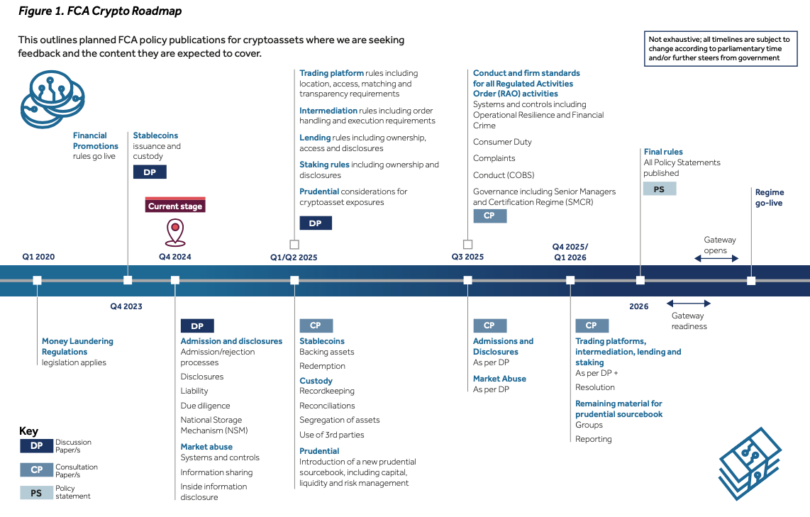

Today the UK’s Financial Conduct Authority (FCA) published a discussion paper on regimes for crypto-asset admissions and disclosures and market abuse regimes. It also reiterated the UK’s timetable for crypto legislation, targeting 2026. A key feature of the admission and disclosures regime is that public offerings of crypto assets will be banned, with two exceptions.

New public offerings of crypto-assets will only be allowed if via a regulated cryptocurrency exchange, or by restricting the offering to qualified investors. The aim is to put the onus on cryptocurrency exchanges to perform sufficient due diligence on offerings and to have a process for rejecting listings for trading. Exchanges may be subject to prudential requirements.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.