Today the U.K.’s Financial Conduct Authority (FCA) says it proposes to ban the sale of crypto derivatives and crypto related exchange traded notes (ETNs) to retail consumers. We have three questions: Is the derivatives ban just the start? Some new blockchain technologies are derivatives themselves, could they face bans? Is it time to bring the definition of a retail investor and sophisticated investor into the digital age?

The FCA cites the reasons for the proposed ban as the nature of the crypto assets and their volatility, the risks of cyber theft and other crimes and inadequate understanding by consumers. It estimates the ban will reduce consumer losses by £75m and £234.3m.

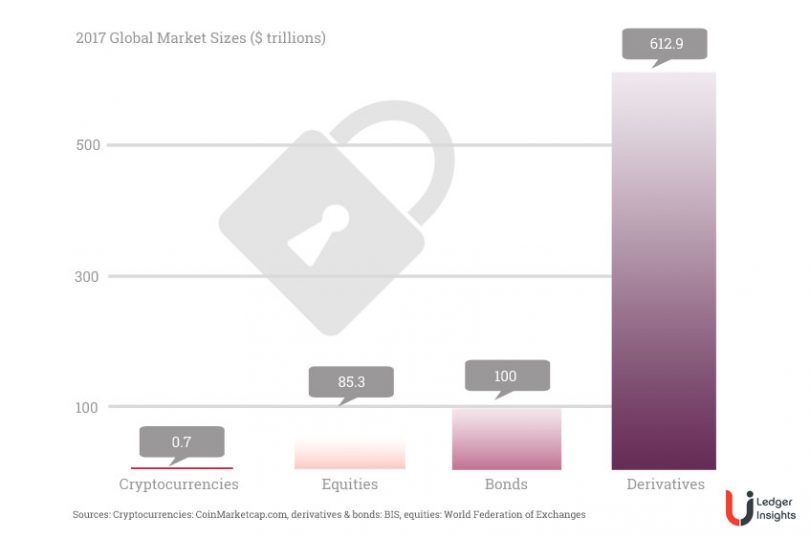

While the market at the moment may be small, the graph above shows how derivatives have a habit of dwarfing their underlying markets.

The announcement cited a similarity to binary options which were permanently banned by the FCA in April. At the time, FCA Director Christopher Woolard described binary options as “gambling products dressed up as financial instruments.”

The consultation report implies that the ban will relate to derivates based on cryptocurrencies. It appears it won’t impact tokenized shares which going forward could be an important (and conventional) market.

Specifically, the report states: “This lack of reliable models for valuations contrasts with other ‘high risk’ asset classes where values might be volatile, but credible valuations can be constructed based on assumptions about dividends/coupons, or use of materials in production or consumption.”

It even gives an example where two analysts arrived at Bitcoin valuations with a 400x difference. Which led Woolard to conclude that “most consumers cannot reliably value derivatives based on unregulated cryptoassets”.

The regulator also ran a ‘noise’ analysis to highlight the speculative nature of cryptocurrency prices. Google searches are highly correlated with prices as are social media tweets from influencers, which have a significant impact on price and sentiment, according to the FCA.

Plus it points to the high fees associated with crypto derivative products. Even though the charges may be justified because of market risk and hedging, this has a significant negative impact on returns.

The questions

Reading through the report, some of the issues highlighted are particular to derivatives. The nature of options and CFDs will magnify gains and losses, which is a massive issue for something which is already volatile. Plus derivatives carry high costs. But much of the report could be used as an argument to ban cryptocurrencies.

The FCA classifies tokens as Security tokens, Utility tokens and Exchange tokens (e.g. Bitcoin). It considers Security tokens and most Utility tokens as already within the regulatory perimeter, but not Exchange tokens. So is banning derivatives a toe in the water?

The second question is, what exactly counts as a derivative? The Dai (Maker) is a US Dollar stable coin collateralized by Ether. Currently more than $440 million in Ether backs $90 million of stable coins. And Maker is planning other types of collateral in the future. Is it a derivative?

Another example is UMA, which describes itself as “A Decentralized Financial Contract Platform”. In other words, a derivatives DAO. Where those derivatives are based on cryptocurrencies, they will likely fall into the ban.

Which leads on to a third question: is it time to revisit the definition of a retail investor? Are regulators trying to prevent people from taking risks or from taking ignorant and uninformed risks? Or both? Some people don’t have the income or assets to qualify as accredited investors but may have sufficient understanding to appreciate financial risks.

Maybe in this digital world, it’s time for a digital test to qualify people as financially knowledgable or not. If someone is willing to risk their shirt and understands the risk, why not let them?