Today Everis, Part of NTT Data, announced Project Fire which will explore the use of hardware devices that allow consumers to hold central bank digital currencies (CBDC). Other participants in the project include the Bank of England, British Standards Institution (BSI), University College London (UCL), and the University of Edinburgh.

UCL is home to the multi-university PETRAS National Centre of Excellence for IoT Systems Cybersecurity, which is funding the project.

The project is more about thought leadership than designing a specific solution for the UK’s CBDC, where a decision on a sovereign digital currency has not yet been made.

A key choice in the design of any CBDC is whether it would be account or token-based. Tokens are seen as potentially offering a greater degree of privacy because, as a bearer instrument, smaller amounts may not need to be associated with an identity. Such a CBDC could either be stored in a custodial wallet by a bank or wallet provider like PayPal, or self custodied by individuals in a similar way to cash.

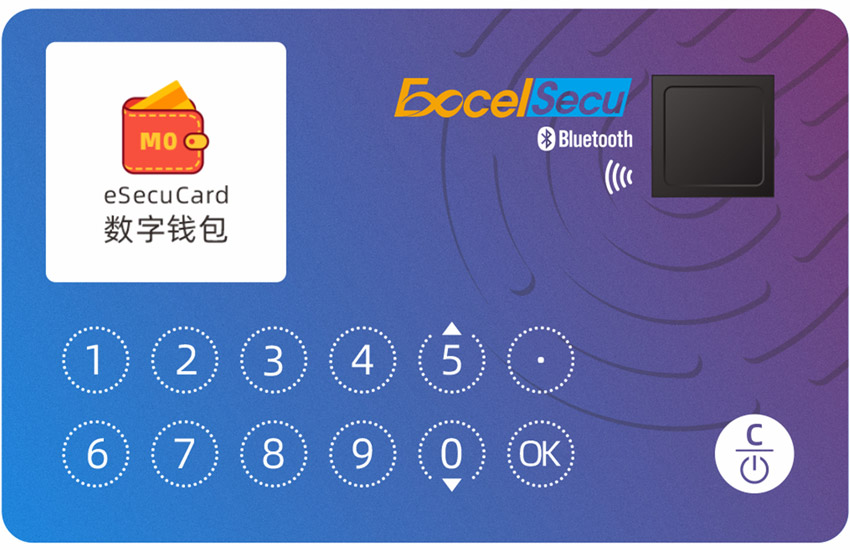

Not everyone will want to hold the CBDC in a smartphone. Smart cards, which are debit cards with tiny buttons, could also act as CBDC hardware wallets. In China’s CBDC pilots, some of these don’t look like your typical debit cards, but instead are fun shapes like keyring decorations.

Depending on the design, a token offers a bigger chance of replicating some of the features of cash without a full digital trail of consumer habits.

Privacy is often discussed as advantageous, but it’s not just about avoiding social media networks knowing how you spend your money. A future where everyone’s transactions are visible and connected to identities could result in mass price discrimination. In some countries, prices could be adjusted based on that knowledge.

And in a less benevolent society, one can imagine entire groups of people being blocked from holding a CBDC.

Digital payments can “introduce new threats to privacy, accessibility, and fairness for consumers, as well as new risks to monetary sovereignty and national security for governments,” said Geoffrey Goodell, Research Associate at UCL.

“By offering consumers a way to directly hold tokens representing obligations of the central bank on inexpensive devices, non-custodial digital currency offers a chance to realise the benefits without incurring the harms. Through the FIRE project, we shall explore how consumers and businesses will interact with non-custodial digital currency, including the devices, the processes, and the interfaces to existing financial infrastructure and services.”

FIRE is short for Future Infrastructure for Retail Remittances.