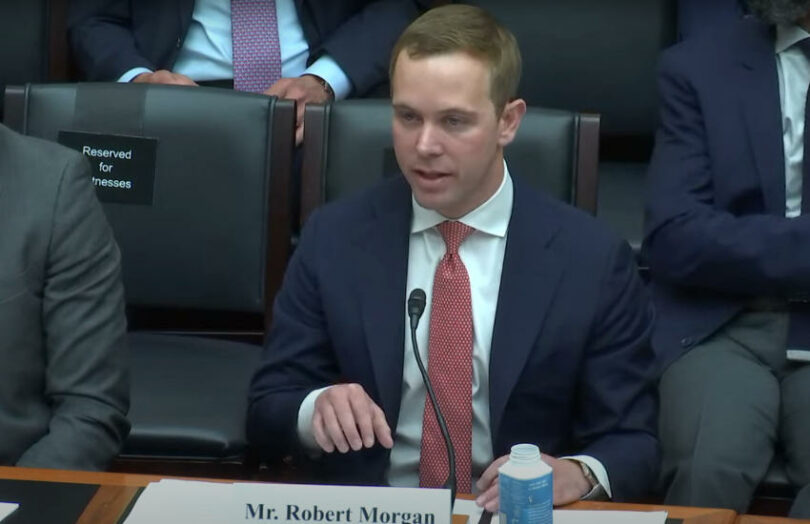

During yesterday’s Congressional hearing on stablecoins, one of the witnesses providing testimony was Robert Morgan, the CEO of the USDF Consortium, the network for bank deposit tokens. Currently, the consortium includes eight community banks, community bank group JAM FINTOP and blockchain firm Figure Technologies.

During the hearing, Morgan argued that the future of digital currency is not a two way choice between stablecoins and central bank digital currency (CBDC). Instead, there’s a third way with tokenized deposits. He noted that currently, 73% of US money is comprised of bank deposits and those deposits support credit origination.

We’d observe that it is rarely noted that a mass migration from bank deposits to stablecoins carries similar risks to the wide adoption of a retail CBDC. The potential reduction in available credit could have a major impact on the economy without an alternative source of credit.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.