Today Visa said it had created a Global Crypto Advisory Practice within its consulting and analytics division. It targets three groups, financial institutions interested in engaging with cryptocurrency, retailers potentially exploring non-fungible tokens (NFTs), and central banks for digital currency. The payments firm also published the results of a retail survey of cryptocurrency attitudes.

It gave an example of its crypto work with the regional Missouri bank UMB. “VCA (Visa Consulting) helped us begin to explore a roadmap of a strategy – from product and partner selection to cross-functional considerations such as Technology, Finance, Risk, and Compliance,” said Uma Wilson, EVP and CIO at UMB Bank.

Crypto survey

Visa’s retail survey found that 40% of current cryptocurrency owners said they’d switch their bank to one offering cryptocurrency services. Additionally, 85% of owners would buy crypto from their bank.

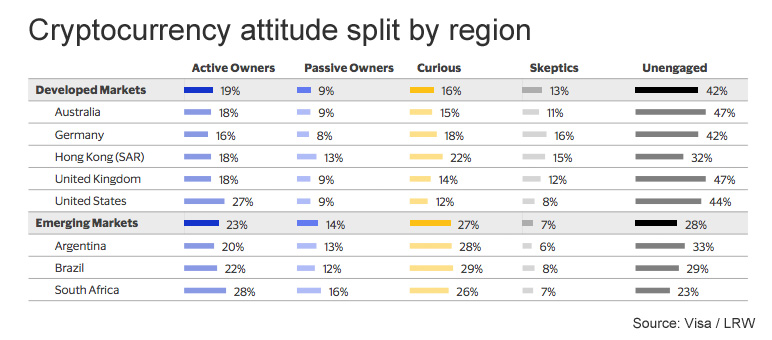

The survey split respondents into active users, passive users, the curious, skeptical and unengaged. Despite the rhetoric that cryptocurrency is a doomsday hedge against inflation, the survey found that active owners are the most confident about the global economy’s health (45%), and they also believe crypto will replace traditional currencies (45%).

Visa’s research reinforced that cryptocurrency owners tend to be wealthier, non-white, younger and male.

Of active owners, 65% are male and women make up 57% of the unengaged segment. Crypto skeptics were more evenly split across genders.

Another key takeaway is the curious don’t believe that cryptocurrencies are easy to use.

Visa’s blockchain engagement

Meanwhile, Visa is ramping up its engagement in the sector. It has provided Visa cards to crypto exchanges for some time, enabling users to spend their digital assets at retail outlets.

Visa has a close relationship with crypto custody bank Anchorage, in which it invested. It worked with the startup to spend $150,000 on a CryptoPunk NFT in August, which coincided with the start of a second surge in NFTs.

It was one of three winners of Singapore’s Global CBDC Challenge working with Ethereum development house ConsenSys. And it’s continuing to invest in the crypto sector, including providing funding to Blockchain Capital (Anchorage’s lead investor) and yesterday supported the $60 million Series B for blockchain intelligence firm TRM Labs. Additionally, it is involved in research, such as the interoperability of digital currencies and offline payments.