Today the World Economic Forum published a report on wholesale central bank digital currencies (wCBDC). The paper briefly summarizes many of the wCBDC initiatives and hones in on top level use cases and how a wholesale CBDC could address long standing industry challenges.

At a high level, one of the main use cases is for interbank payments. That includes both domestic and cross border payments. In the latter case, a wholesale CBDC can serve as a settlement asset for Nostro accounts, supporting existing correspondent banking arrangements. Alternatively, it can provide a direct settlement instrument.

The other high level use case is for securities settlement, enabling delivery versus payment for tokenized or conventional assets. Additionally, a wholesale CBDC could be used as collateral.

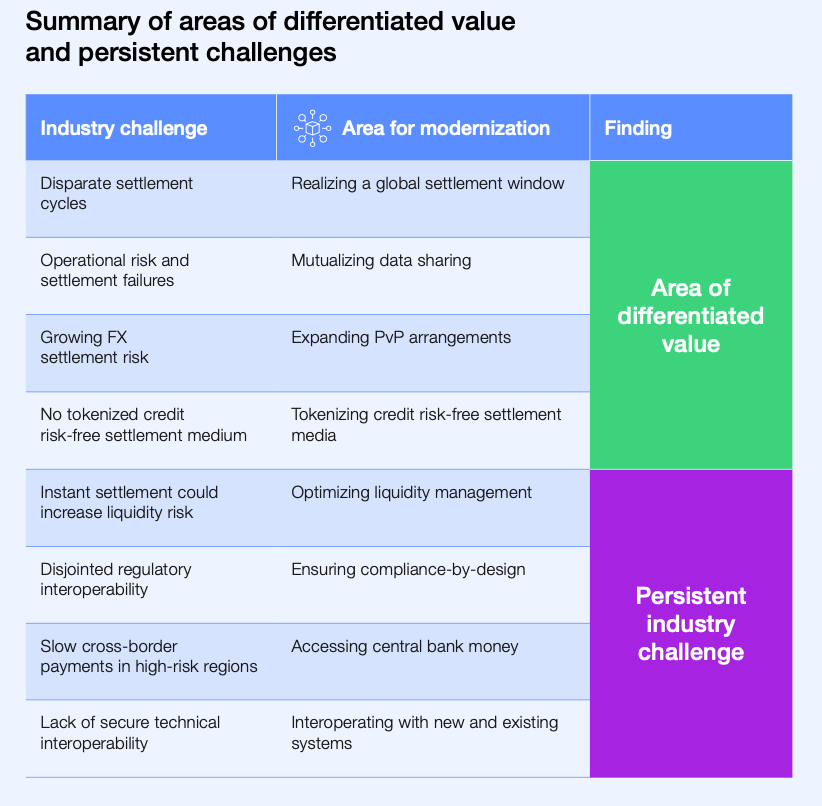

The bulk of the paper outlines eight areas where a wCBDC could provide differentiated value or address industry challenges.

Wholesale CBDC to address industry challenges

For example, in the case of cross-border securities settlement, most real-time gross settlement (RTGS) systems have limited operating hours. The BIS has identified a five-hour window (6-11 am GMT) with a maximum overlap. However, achieving such a global settlement window will still require extensive adjustment of RTGS working hours. Accenture suggests a wholesale CBDC could supplement RTGS systems by operating at near 24/7 cycles.

Another example of industry challenges is the extensive number of settlement failures, which are likely to rise with securities settlement times shortening from T+2 to T+1. Using a shared DLT infrastructure as a single source of truth could reduce failures. A wholesale CBDC would provide the settlement asset.

One of the most touted benefits of DLT is atomic settlement for securities transactions, which eliminates counterparty risk. However, when traditional finance (TradFi) started to seriously consider DLT around six or seven years ago, TradFi participants highlighted an important issue: atomic settlement significantly increases the requirement for liquid funds at certain times of the day. In contrast, conventional systems support liquidity savings mechanisms (LSMs) such as netting, queuing, and offsetting.

So, there’s a question mark about whether a wholesale CBDC can address liquidity risk challenges. One point not mentioned in the report is recent research showing that netting might be viable on an hourly basis in highly liquid markets. In other words, having the best of both worlds might be possible.