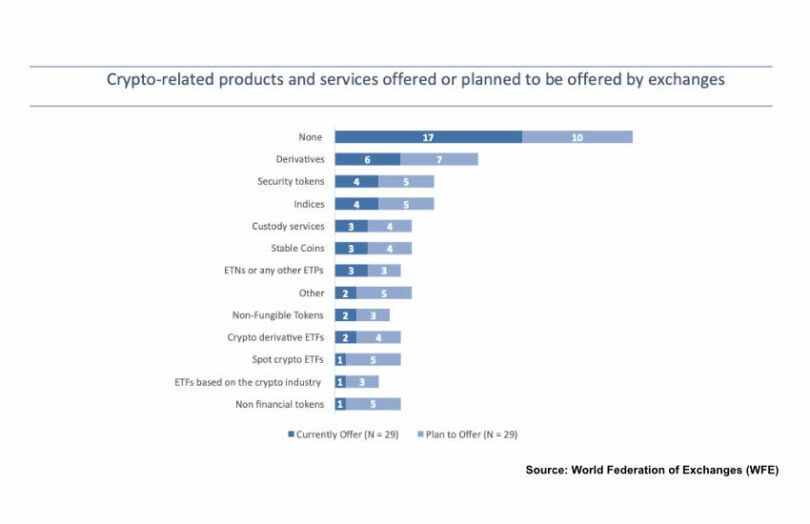

Today the World Federation of Exchanges (WFE) published its first of two reports on regulated commodities and stock exchanges engaging in cryptocurrencies. A survey with 29 respondents found that 12 are participating at some level, although only one provides direct exposure to pure cryptocurrencies such as ETH. The report also reviewed research around centralized (CEX) versus decentralized (DEX) crypto exchanges.

One survey finding was that regulated exchanges see the crypto sector as providing an opportunity to develop technology. The potential of a new revenue source ranked equally highly. And exchanges value the potential to broaden investor choice.

When asked about the perceived challenges in getting involved in crypto, every respondent mentioned regulation. That’s despite almost two thirds coming from the EMEA region, with the EU passing MiCA regulations. However, the WFE conducted the survey late last year, whereas MiCA received final approval this year.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.