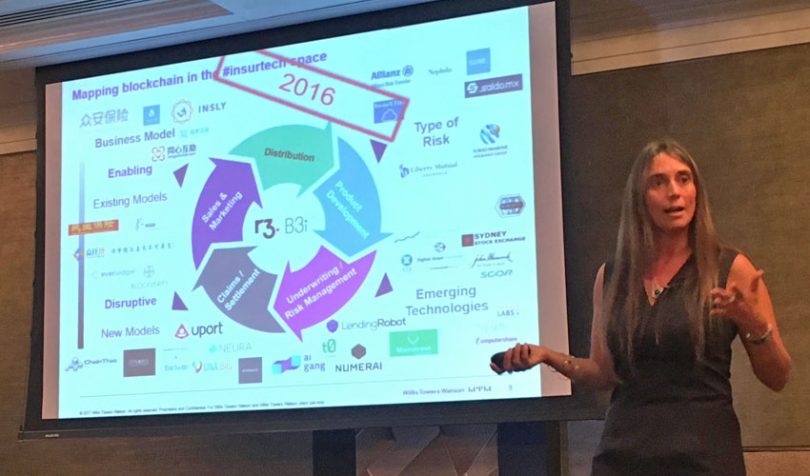

In advance of the Blockchain for Insurance conference in London on June 18-19th, we interviewed blockchain and insurance innovation expert Magdalena Ramada Sarasola, InsurTech Innovation Leader at Willis Towers Watson (WTW).

“Blockchain was originally not meant for enterprises,” says WTW’s Magdalena Ramada Sarasola. “It was meant for peer-to-peer value transfer. So every time I come across enterprise applications, I’m a bit sceptical, given many of them are not leveraging the right attributes of blockchain technology and are trying to force its use in areas that do not make sense.”

She continued: “Some of them though, use the same principles that enabled blockchain to become a decentralized P2P value transfer platform, to enable B2B enterprise ecosystems, which is a great way of applying blockchain in the context of complex enterprise value chains. In these ecosystems anonymity is less of a problem, but there’s a need to address conflicts of interest, lack of trust or transparency, and to have one synchronized – as opposed to many reconciled – ledger(s). A great example of this is what

B3i or R3 are doing. They are applying the concept of peer-to-peer decentralization to a network of enterprises. ”

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.