Highlights

-

* Facebook rumored to be seeking $1 billion in VC for crypto venture

* Remittances to India to be first target

* Facebook won’t handle cash. Online competition is more cut throat

* Online remittance costs from U.S. to India closer to 1.37% not 6.94%

* With 20% market share, Indian revenue may be $216 million. FB global revenues $56 bn

Yesterday New York Times reporter Nathaniel Popper tweeted that sources told him that Facebook is looking to raise up to $1 billion in venture capital for its secretive cryptocurrency venture. Based on other leaked Facebook information we offer some basic analysis of the revenue opportunity.

How juicy are remittances?

The rumored target market for Facebook is remittances, initially to India. Popper stated that one person he spoke to said the money was for collateral for its cryptocurrency, in order to keep it stable by pegging it to a basket of foreign currencies held in bank accounts.

But our analysis below shows that the remittance market is not that big, and the margins are not as juicy as one might think. That’s particularly the case for a company like Facebook with high margins and revenues of almost $56 billion in 2018. Our figures show that if Facebook managed to grab as much as 20% of the remittance market to India, it might be worth just $216 million.

Yesterday the World Bank announced the latest 2018 remittance statistics. It estimates that the global market for remittances is $689 billion up 8.8% on 2017. Remittances are defined as small consumer payments often $200 – $500 each. The World Bank states that India is the largest destination at $79 billion followed by China ($67 billion), Mexico ($36 billion), the Philippines ($34 billion), and Egypt ($29 billion).

India also happens to be Facebook’s single largest audience, estimated at 270 million (source: Hootsuite).

Don’t use the headline figure

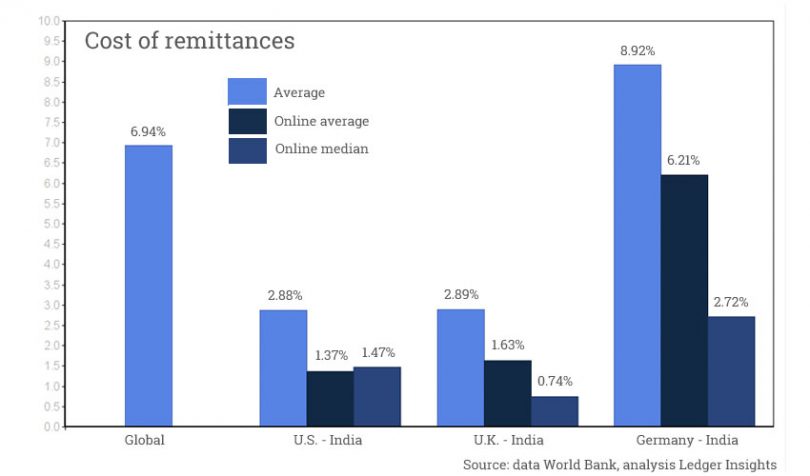

World Bank figures show the global average cost of remitting $200 is 6.94% (Q1 2019). Using that percentage (which is hugely over-stated), the global fees on remittances works out at $47 billion. Or for India $5.48 billion. These look like attractive market sizes until you start breaking down that 6.94%. According to the World Bank, weighting the figure by source and destination it’s more like 5.2%.

If the cost percentage was closer to 1.37%, not only would the entire Indian market be worth just $1.08 billion in potential revenue, but it’s also hugely competitive at those rates. So the likelihood of grabbing much more than 20% might be slim. And to get that slice the price might need to be lower than 1.37%. Twenty percent would represent $216 million. While not a small figure, it’s almost a rounding error for a company of Facebook’s size.

Because India is a popular remittance destination, rates tend to be far lower than the 6.94% average. The cost of sending $200 from the U.S. to India is 2.88% on average, or for remitting $500, it’s 1.73%. But we believe these figures are still not quite right for the Facebook analysis. 2.88% is a simple average of 30 different offerings. On the one end of the scale, the World Bank lists Citibank as offering zero-fee and remittances with zero foreign exchange margins.

On the upper end is Moneygram at 6.42%. Some of Moneygram’s rates are as low as 2.36%. The higher price is for using cash at both ends of the remittance, and settlement within an hour. In general, expensive rate quotes involve cash, because banks charge a lot for cash handling and it’s risky.

As soon as you look at online-only rates, many channels are quite competitive. For the U.S. to India payment channel only nine of the thirty were internet and cashless both ends. This is the market where Facebook might compete. For these nine, the average rate was 1.37% for $200, the median was 1.47%, and the four cheapest were 0.52% or less.

We acknowledge that the 1.37% rate is based on the U.S. market alone. A fuller analysis would use a weighted average of online costs based on proportionate volumes of money sent to India from different countries. But the volume data is not easily accessible. We believe weighting is essential because heavy traffic channels offer more competitive rates.

Assuming Facebook is looking at remittances, doubtless, it would only be part of a much larger plan. Some of the biggest online payment players such as Paypal and Alipay have instead initially targeted e-commerce. Remittances alone aren’t likely to have a significant impact on Facebook’s revenues.