Facebook has been building a blockchain team for several months but has yet to announce anything. This morning Bloomberg reported that Facebook is developing a US Dollar stable coin cryptocurrency to enable WhatsApp users to make remittances to India. Facebook’s revenue per user is far higher in North America than elsewhere. Hence, if the company could increase revenues for users outside the U.S., it could have a dramatic impact on its top line.

Six months ago Ledger Insights speculated that there was a good chance that Facebook was working on something payments related. That was based on the team led by former Paypal president David Marcus with other Paypal hires. In particular, Tomer Barel joined as Head of Risk & Operations for blockchain. As SVP at Paypal he was Global Chief of Risk and Data.

India’s appeal

The Indian angle makes sense for multiple reasons. Firstly India is the country with the largest number of Facebook users at 270 million (source: Hootsuite). It overtook the U.S. last year which currently has a 210 million audience. The other top five countries are Brazil, Indonesia and Mexico.

According to the World Bank, the global remittance figure for 2017 was $613 billion, of which $69 billion was Indians sending money home. The remittance market is classified as low-value person-to-person payments. The UN estimates that sending a payment of $200 costs on average 7.1 percent in the first quarter of 2018.

That means the potential revenue from the global remittance market is $43 billion and the Indian market is $4.9 billion. One would hope that blockchain will reduce those costs and cheaper fees will attract customers away from existing outlets. Over time Facebook must have the potential to take a very significant slice of that market, especially in India.

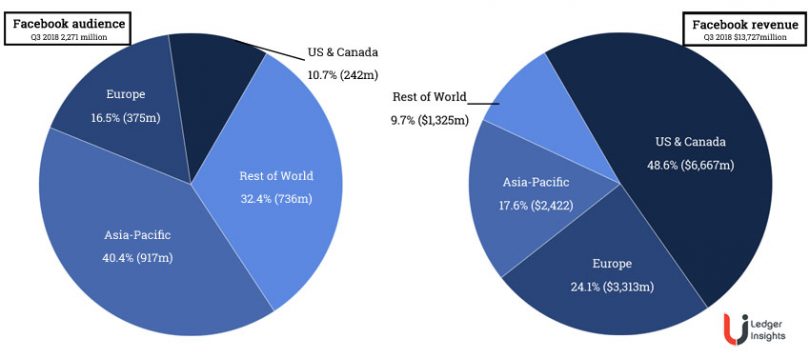

According to Facebook’s latest quarterly report, Asia-Pacific makes up 40.4% of Facebook’s audience but just 17.6% of its revenue. Beyond advertising revenues, the region fares even worse for payments and other Facebook income. Facebook’s total average revenue per user (ARPU) in Q3 2018 is an impressive $27.61 in the US & Canada compared to just $2.67 in Asia-Pacific and a global figure of $6.09.

So finding ways to earn more money from a market like India could have a positive effect on Facebooks’s earnings. But at the same time, Facebook is encountering a stream of privacy issues. The question is whether these problems could hamper adoption of Facebook blockchain payments. Notably the Bloomberg news refers to payments via WhatsApp rather than Facebook. A survey by SpreadPrivacy found that half of U.S. adults were not aware that WhatsApp is owned by Facebook.

At the same time, UAE based Finablr which owns Travelex and Express Money had better make a move on with it’s IPO before Facebook starts to dent its income.

Neither the author nor any of the Ledger Insights team owns shares in Facebook