Today Alipay announced that its Xiang Hu Bao online mutual aid platform has attracted 50 million participants within six months. The company is targeting 300 million in two years. The application leverages Alipay’s blockchain technology.

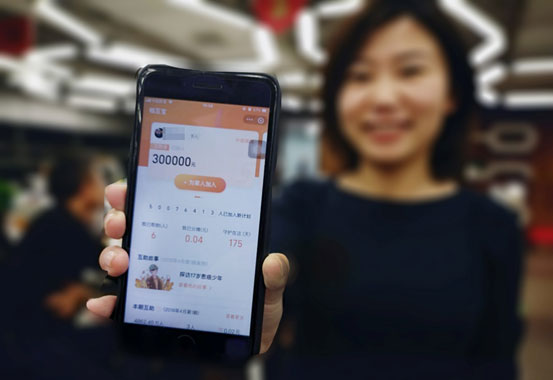

Xiang Hu Bao translates to “mutual protection”, and Alipay is keen to emphasize it’s not a health insurance plan and complements premium health insurance plans with broader coverage. Xiang Hu Bao protects participants against 100 critical illnesses, and if claims are approved, participants receive one-time payouts up to a maximum of RMB 300,000 (US$44,600).

For members, there are no premiums, purely contributions for payouts. The cost of claims is shared amongst members as a collective with Alipay taking an 8% cut. The fee needs to cover the cost of claims processing. Given it’s Alipay, one can imagine AI is an important tool in the claims process. Participants can exit the scheme provided they’ve contributed to any pending claims.

Alipay positions the platform as inclusive, noting that 47% of participants are migrant works. It states that low-income groups can’t afford premiums and advance payments typical of commercial health insurance products. A survey by the Insurance Association of China shows that only 6.7% of respondents purchased commercial health insurance. But government figures show 1.35 billion are covered by basic medical insurance.

Other mutual aid platforms have floundered owing to fraud and a lack of transparency. In this case, public disclosure of all claims is made using the blockchain. We’ve asked Alipay what level of details are included and who hosts the blockchain nodes.

According to a November report by China.org.cn, the plan attracted ten million users within a week of launch and Trustmutual Life Insurance was initially a partner. But industry regulators were concerned about misleading product promotions and insufficient disclosures. Trustmutual Life stopped selling the product, is no longer an underwriter and it’s now solely an Ant Financial / Alipay product. Alipay renamed the product as “mutual aid” and capped the amount of money that a member might have to pay for the whole of 2019.