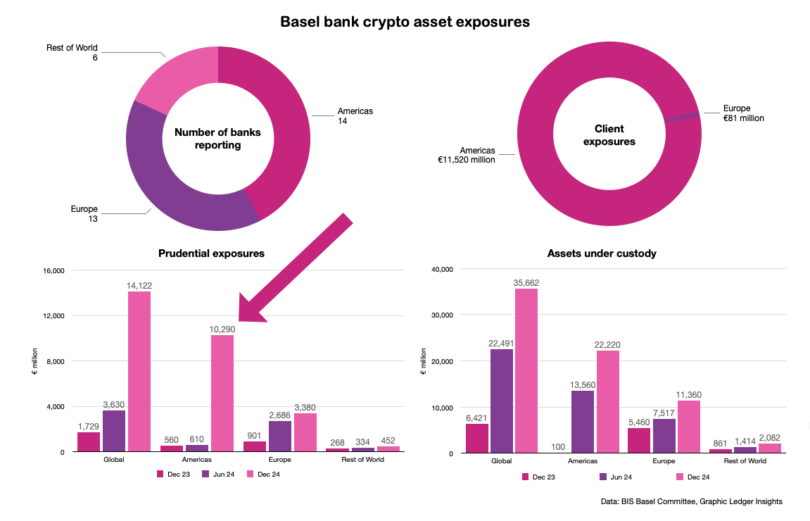

The Basel Committee on Banking Supervision has published Basel III monitoring statistics for December 2024, including digital asset exposures. The most significant change is the substantial increase in prudential exposures to crypto for banks based in the Americas. Prudential exposures refer to assets held on the bank’s balance sheet for their own account.

At the end of June 2024, the figure was €610 million. By the end of December 2024, this figure had surged to €10.3 billion ($12 billion), marking a sixteen-fold increase. Europe showed more modest growth of 25% to €3.4 billion. Banks have generally avoided holding crypto on their balance sheets because the Basel rules discourage it by requiring banks to hold 100% capital against most crypto exposures.

This dramatic increase followed President Trump’s November 2024 election victory, with banks potentially anticipating that the Basel rules might not be strictly enforced for crypto. That’s certainly the White House position in its digital asset report.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.