Today Aon, the world’s second-largest insurance broker, formally announced its involvement in a blockchain microinsurance project targeting Sri Lankan farmers. The project is in collaboration with Oxfam and Etherisc, the German decentralized insurance startup. The insurance policies are registered on the public Ethereum blockchain. So far, nearly 200 farmers have enrolled in the solution. It’s targeting 5,000 farmers for now.

Oxfam has leveraged its on-the-ground expertise and engagement with the farming community. “Allowing farmers to access the blockchain platform is an important milestone that is bringing an effective and affordable risk transfer mechanism to a large portion of the Sri Lanka economy,” said Bojan Kolundzija, the Country Director of Oxfam in Sri Lanka.

This is a parametric insurance project which automates the claims process based on weather events so that it’s not necessary for the farmer to make a claim or a claims adjuster to visit.

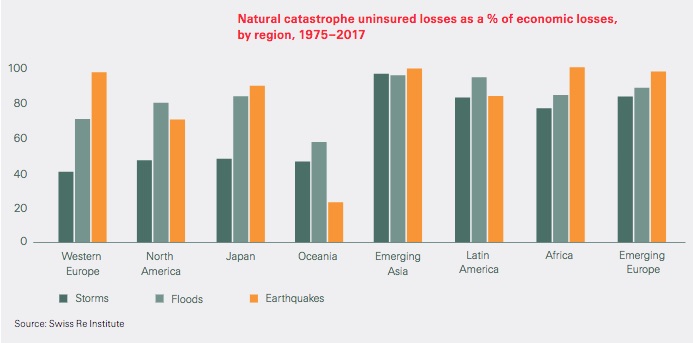

According to Swiss Re Institute in the last ten years, only 30% of catastrophe losses were insured. But the figures are worse in regions such as Sri Lanka.

Hugo Wegbrans, Aon’s Global Chief Broking Officer provided numbers in a presentation about the project at the Blockchain for Insurance summit. In South America agricultural coverage is just over 2.5%, in Africa it’s 0.3% and it’s even less in Asia.

The project aims to address the lack of affordable insurance projects and removes issues around claims processing. Because the costs of processing claims will be lower, a higher proportion of the premium goes towards risk cover.

Aon’s Wegbrans commented that the collaboration “allows us to broaden the potential positive impact we can have on people, families and small businesses around the globe.”

Responding to questions Aon’s Wegbrans clarified that there is existing insurance that the blockchain project is replacing. But moving insurance onto blockchain which is what has happened now, is just the first step. “From that we want to build it out to getting the entire value chain involved there. And then we want to look at rather than paying in money, paying in kind.” So when there’s a claim, compensation would be provided in the form of new seeds and agrochemicals.

“The thing we want to build is the infrastructure to deal with these kinds of volumes and this kind of parametric insurance to then use that platform to go outside [elsewhere].” By leveraging efficiencies wherever possible, it makes delivering microinsurance more viable.

“Farmers represent a third of the workforce and account for almost 20 percent of the economy, yet very few have insurance,” said Michiel Berende, Chief Inclusive Officer at Etherisc. “This made Sri Lanka a perfect candidate to feel the benefits of decentralized, collaborative and automated insurance.”

Blockchain and parametric insurance go well together. This is one of the first to go live, but there are several in the works. We previously wrote about startup Skyline Partners which is targeting the Indian tea sector.