Australian Securities Exchange Ltd (ASX) on Thursday announced its FY19 results in which it elaborated on the long-awaited CHESS replacement that uses distributed ledger technology (DLT) or blockchain. While the company reaffirmed its previous announcement of rolling out the DLT-based post-trade system by March 2021, it added that it has formed a DLT Solutions team.

“Our DLT Solutions team is having a range of discussions about equity and non-equity related opportunities,” said CEO Dominic Stevens. “We are looking at other ways we can use our growing expertise to help customers identify how they might be able to benefit from using a distributed ledger.” More than 100 new staff have been hired in the last year, some of whom are supporting the new CHESS service.

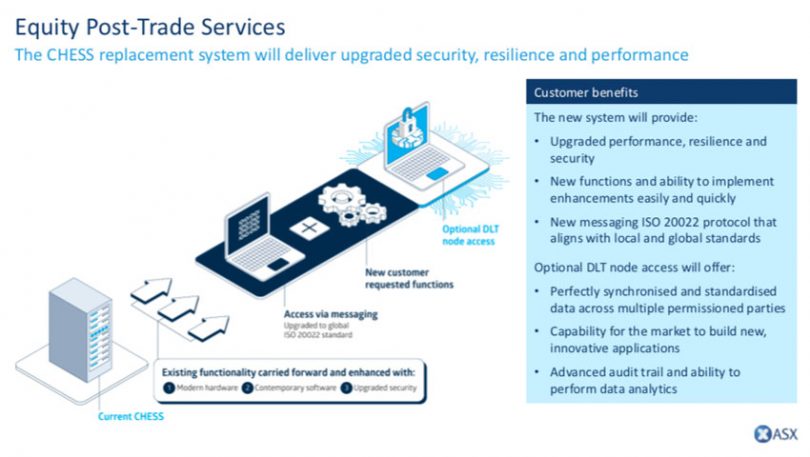

The CHESS replacement project, which ASX is running with help from US-based software firm Digital Asset (DA), is built using the Digital Asset Modelling Language (DAML). ASX is an investor in DA. Additionally, CHESS will use the ISO 20022 protocol, the messaging standard being adopted by the Reserve Bank of Australia (RBA) and other exchanges around the world.

Although the project is on track, in the recent past, the CHESS replacement has hit some hurdles. For example, some share registry firms complained about the invasion of their turf. But the ASX responded by working with regulators and customers. It also invited stakeholders and representatives to join the Business Committee, the body overlooking the exchange’s clearing and settlement services.

ASX said that the new system will provide “upgraded security, resilience and performance” and enable a market participant to access the platform by taking a DLT node which will be “secure, privately permissioned and operate behind ASX’s perimeter firewalls”.

Another benefit of blockchain in post-trade services is the synchronization of the user to “source-of-truth data” without the need for messaging and a costly reconciliation process.

“The new system will enable customers to clear and settle equities in the Australian market just as CHESS does today — but with a system that offers better performance, resilience and security, as well as new functions requested by customers during our extensive market consultation,” said CEO Stevens.

Any user who does not wish to take a DLT node can access the ledger using messaging standards. Here, only ASX can make changes to the ledger, with users aligning with regulatory prerequisites having read-only access.

“We are excited by the possibilities of providing a trusted ledger state to those who have permission to see it. If you can do this, the wider industry will be able to innovate in areas well beyond clearing and settlement of cash equities,” Stevens said.