Today, the Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre (DFCRC) released the results of Australia’s central bank digital currency (CBDC) pilot that involved 16 use cases. The pilot’s aim was not technical but rather about how a CBDC could be useful given Australia already has an efficient electronic payments system. The conclusion was that the decision about a potential eAUD is still “some years away.”

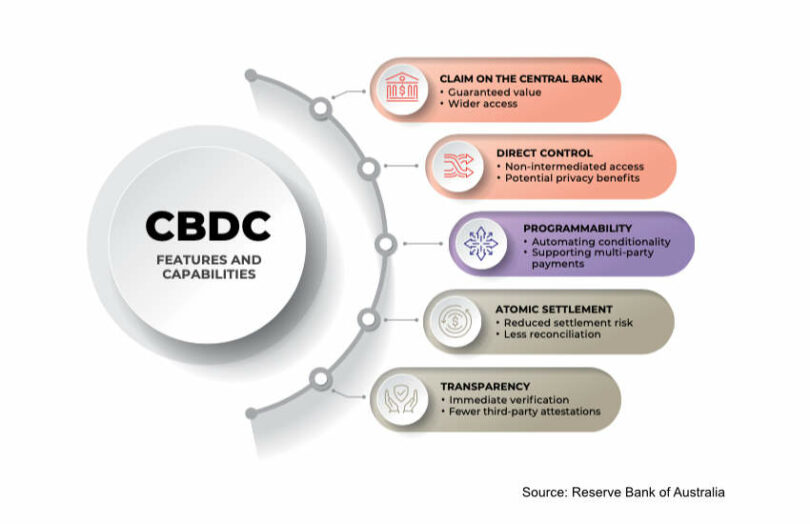

Two stand out use case areas were for ‘smarter’ programmable payments and to use a CBDC as a settlement asset for financial markets. In many cases, it was observed that a CBDC can remove the need for a centralized clearing, reducing the role of an intermediary to matching bids and offers and orchestrating a trade.

“The key findings from the project will help to shape the next phase of the RBA’s research program into the future of money in Australia,” said Brad Jones, Assistant Governor (Financial System) at the RBA. “Alongside our ongoing work on cross border payments, this will include deepening our understanding of the role that tokenised asset markets and programmable payments could have in the Australian economy.”

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.