Today, the Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre (DFCRC) released the results of Australia’s central bank digital currency (CBDC) pilot that involved 16 use cases. The pilot’s aim was not technical but rather about how a CBDC could be useful given Australia already has an efficient electronic payments system. The conclusion was that the decision about a potential eAUD is still “some years away.”

Two stand out use case areas were for ‘smarter’ programmable payments and to use a CBDC as a settlement asset for financial markets. In many cases, it was observed that a CBDC can remove the need for a centralized clearing, reducing the role of an intermediary to matching bids and offers and orchestrating a trade.

“The key findings from the project will help to shape the next phase of the RBA’s research program into the future of money in Australia,” said Brad Jones, Assistant Governor (Financial System) at the RBA. “Alongside our ongoing work on cross border payments, this will include deepening our understanding of the role that tokenised asset markets and programmable payments could have in the Australian economy.”

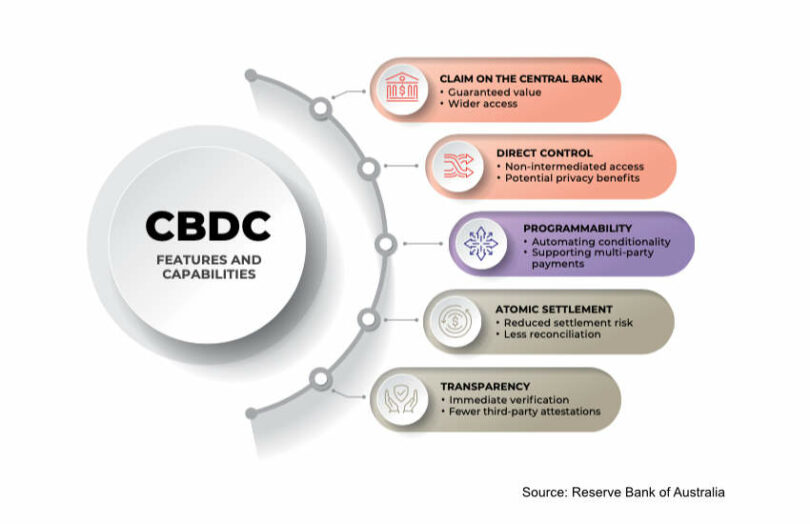

Per the graphic, a CBDC can yield five key benefits: the guaranteed value, direct control without intermediaries, programmability, atomic settlement and transparency. However, the majority of participants preferred privacy over transparency.

The central bank also noted that tokenized bank deposits and stablecoins can provide many of the same benefits.

Which kind of CBDC platform deployment?

One of the key findings was a need for further research into which kind of infrastructure option to use for a CBDC, the deployment model. However, the authors highlight the project did not intend to explore technology issues.

During the pilot the central bank had its own private Ethereum blockchain ledger, which did not support end users running smart contracts. The alternatives are to issue CBDC directly onto industry platforms or to allow industry smart contracts to be deployed onto the CBDC ledger.

Because the direct use of smart contracts was not supported, the CBDC had to be wrapped and issued on other blockchains to enable programmability and atomic settlement. The central bank’s concern is this introduces complexity and risk.

It also notes that ideally atomic settlement should happen where the digital asset and digital currency is on the same platform. Otherwise an interoperability mechanism is needed. “Cross-network ‘bridges’ on DLT networks are not yet robust, but viable solutions could emerge in the future,” the authors wrote.

Our view is the likelihood of allowing smart contracts to run directly on the core CBDC ledger seems slim. It would require the contracts to be heavily audited, and would still pose significant risks.

Meanwhile, we previously explored several eAUD use cases, including atomic settlement for securities, CBDC backed stablecoins and Mastercard’s use of eAUD on a public blockchain. At the same time, the Reserve Bank of Australia is also exploring the pros and cons of stablecoins and multiple Australian banks are piloting them (ANZ and NAB).